Climate Mitigation

Description

Including reducing or eliminating greenhouse gas emissions (scope 1, 2, & 3); energy efficiency; reducing energy use; renewable energy; energy storage; carbon dioxide removal; climate justice; understanding and addressing historical emissions; and loss and damage compensation.

Share this Subissue on:LinkedIn

Resources

Setting Targets and Commitments for Emissions Reductions

Science Based Targets

Building on the momentum of the Science Based Targets initiative (SBTi), the Science Based Targets Network (SBTN) is a collaboration of 45+ global non-profits and mission-driven organizations working together to develop guidance to set science-based targets for all of Earth’s systems. Science Based Targets has created a five-step target-setting framework that helps you to assess; interpret and prioritise; measure, set, and disclose; act upon; and track your science-based goals. They have also created sector-specific guidance and target monitoring for companies and financial institutions.

At present, Science Based Targets helps companies to develop their goals based on the latest science: SBTi specifically focuses on GHG emission reduction goals, and SBTN specifically focuses on nature positive goals, with target-setting guidance for land, biodiversity, and freshwater. Their respective websites provide comprehensive resources, cases, and support for taking credible action.

Greenhouse Gas Protocol

This is the global standard for measuring GHG emissions. The protocol was developed by the World Resources Institute (WRI) and World Business Council on Sustainable Development (WBCSD) and includes sector specific guidance and calculation tools.

The Net-Zero Standard

The Science Based Targets initiative’s (SBTi) Corporate Net-Zero Standard includes the guidance, criteria, and recommendations companies need to set science-based net-zero targets consistent with limiting global temperature rise to 1.5°C. The framework consists of four parts: 1) setting near-term interim science-based targets for rapid, deep emissions cuts, 2) setting long-term science-based targets that align with reaching net-zero at the global or sector level by 2050 or sooner, 3) neutralizing residual emissions, and 4) taking action to mitigate emissions beyond the value chain. This resource also includes specific sector guidance for setting science based targets, as well as guidance for updating and communicating targets. It should be noted that SBTi has reduced their restrictions related to acceptable carbon removal practices, including offsetting, but the document highlights that only the final 5-10% of emissions may be neutralized this way in order to qualify as net-zero. It should also be noted that SBTi is now undertaking a major revision, which will result in V2.0 of the Corporate Net-Zero Standard. Until then, businesses seeking to set SBTi-aligned net-zero targets should use the current Corporate Net-Zero Standard V1.2.

The Evolution of Corporate Climate Commitments: The Role of Carbon Credits in Achieving Net Zero, Carbon Neutrality, and SBTi Targets

New and increasingly sophisticated carbon reduction targets have emerged as organizations look to aggressively reduce their emissions. This resource from 3Degrees will help you to understand the difference between three increasingly commonly climate-related targets: carbon neutrality, science-based targets, and net zero emissions. The guide also highlights solutions for addressing unabated or residual emissions.

The World Roadmap to Net Zero by 2050

The IEA's World Roadmap to Net Zero by 2050 is essential reading for businesses directly and indirectly involved in the energy industry. This guidance will help you to understand what is needed from companies, governments, investors, and citizens to fully decarbonise the energy sector and set emissions in line with the 1.5° C target. The guide outlines what a cost-effective and economically productive pathway could look like, and explores key uncertainties, such as the roles that bioenergy, carbon capture, and behavioural changes will play in reaching net zero.

Integrity Matters: Net zero commitments by non-state entities – A briefing for board directors

This UN report sets out five key principles and ten key recommendations that can help board members to develop and implement credible and comprehensive net-zero commitments. This resource provides a holistic set of meaningful actions that companies can take, as well as key questions directors should ask.

Engaging Supply Chains on the Decarbonization Journey: A Guide to Developing and Achieving Scope 3 Supplier Engagement Targets

This guide by the Science Based Targets initiative (SBTi) will help address your value chain sustainability impacts by setting supplier engagement targets. It explains how to select suppliers, set and implement targets, and track progress. The guidance will be most useful to sustainability and supply chain management teams that are exploring or already working to reduce their organization’s Scope 3 emissions.

Achieving global climate goals by 2050: Pathways to a 1.5° C Future

This report from the ClimateWorks Foundation can help you better understand the distribution and scale of climate mitigation opportunities. Based on scenario modelling, it highlights priority areas across eight geographies and eleven sectors. This resource will be most useful to sustainability practitioners and business leaders interested in the broader context of the transition to net-zero by 2050.

Net Zero Stocktake 2024

This comprehensive report from Net Zero Tracker can help you to better understand the status and trends of net zero target setting across countries, subnational governments and companies. It features insights into the progress of whole-economy net zero target-setting and the overall performance of more than 4,000 entities on key elements of net zero intent and integrity, including all states and regions in largest 25-emitting countries in the world, all cities with more than 500,000 inhabitants, and the largest 2,000 publicly listed companies in the world. These insights will be most useful to sustainability practitioners seeking to benchmark their performance against industry peers and to learn more about the progress gap in the locations where they and their value chain members operate.

The MSCI Net-Zero Tracker

This periodic report from MSCI can help you understand the progress of large companies on mitigating climate risk. It monitors listed companies around the world and their alignment with the 1.5 °C warming threshold. It highlights leaders and laggards on corporate climate disclosures, and includes a review of both financed emissions and the economic opportunities associated with the climate transition, such as clean tech and climate investment. These insights will be most useful to sustainability practitioners seeking to benchmark their performance, highlight opportunities, and point out the remaining ambition gap in their organisation.

Climate Action 100+ Resource Hub

This resource hub from InfluenceMap’s Climate Action 100+ (CA100+) initiative can help you better understand corporate climate policy engagement. The site features a series of tools that show which organisations are contributing to - or hindering - climate policy. These include the CA100+ Company Rankings and Industry Association Rankings, with rankings determined by alignment with the Paris Agreement; Corporate Disclosure scorecards, which assesses the accuracy and credibility of corporate sustainability reporting; and Shareholder Resolutions, featuring real world investor briefings created by InfluenceMap to support shareholder voting decisions on corporate climate policy.

This set of tools was designed for investors, but they will be useful to anyone interested in benchmarking and ensuring consistency between their business’ commitments and actions on climate change.

Climate Action 100+ Net Zero Benchmark

Climate Action 100+ is an investor-led initiative led by AIGCC, Ceres, IGCC, IIGCC, and PRI, and it can help you understand the performance of the world’s largest GHG emitters toward a net zero transition. Bringing together research from the Transition Pathway Initiative, Carbon Tracker, InfluenceMap, and Rocky Mountain Institute, the Net Zero Benchmark provides an assessment of company emissions reductions, climate governance, and climate-related disclosures. It features a searchable database of over 150 company assessments, sharing key findings since 2021. This evaluation and benchmarking tool is designed for investors but will also be useful to sustainability practitioners.

Taking Action to Reduce Emissions

Addressing Scope 3: A Start Here Guide

A guide for leaders of companies of all sizes to understand the basics of Scope 3 emissions and how companies should begin to take credible action. The guidance is anchored in the real-world experience of companies that are already navigating this journey.

Degree of Urgency: Accelerating Actions to Keep 1.5°C on the Table

This report from the Energy Transitions Commissions (ETC) assesses progress since COP26 and outlines the priority areas for accelerated action at - and beyond - COP27. The report provides a good summary of the achievements of COP26, the status of our climate budget, the credibility and quality of global climate-related commitments, and the steps required to close the 'gap' in climate-related ambition, implementation, and financing within both sectors and countries. This resource is a good starting point for executives, boards, and junior sustainability change agents that want to get up to speed on the priority areas for accelerated progress on climate action.

Accounting for Natural Climate Solutions Guidance

Natural climate solutions have been recognised as key levers in mitigating the negative impacts of climate change, with ~12% of global impacts from GHG emissions coming from land use and land-use changes (LULUC). To support you in calculating, accounting for, and reporting on LULUC-generated GHG emissions, the Accounting for Natural Climate Solutions Guidance from Quantis delivers a robust methodology to embed land-related emissions in corporate and product footprints, which can be used for setting science-based climate targets. Additionally, the supporting Annex document provides detailed information on the scope of the proposed methodology, including technical instructions, context, debated challenges, and limitations, as well as references.

Climate Action Pathways

First launched in 2019 by the UN's Framework Convention on Climate Change, the Climate Action Pathways set out sectoral visions for achieving a 1.5° C resilient world in 2050. Pathways are a living document, and will provide you with an up-to-date road map of the interim actions and key impacts needed by 2021, 2025, 2030 and 2040 to achieve the 2050 vision.

The Pathways are divided into executive summaries and action tables that cover thematic areas linked to climate change, such as energy, industry, land use, transport, and water, as well as cross-cutting themes like resilience. The summaries provide a vision of the future, summarising the needs - and milestones - for system transformation and progress to date, whereas the action tables highlight specific time-bound actions that businesses (and other relevant stakeholders) can take to deliver on 2050 vision.

Sink or swim: How Indigenous and community lands can make or break nationally determined contributions

This paper, authored by researchers from World Resources Institute and Climate Focus, examines the role of Indigenous peoples and local communities' (IPLC) lands as carbon sinks and the impact they can have in support of nationally determined contributions (NDCs) towards reducing global emissions. It explains the contributions of IPLC lands to reducing climate change; their current role in countries' current NDCs; key policy and governance gaps to achieving greater mitigation potential from IPLC lands; and recommendations for governments and international donors. This paper can help you to better understand the positive impact you can have in reducing emissions by supporting national projects that protect and grow IPLC lands.

Climate Solutions at Work

This guide from Drawdown Labs was created to "democratize" climate action by helping all employees concerned about climate change to take concrete action in the workplace. It identifies ways for employees to assess whether or not their company is taking adequate steps to address climate change; examines job functions that have untapped potential for driving action; explains how one can work with their colleagues to amplify and hasten impact; and uses the Drawdown-Aligned Business Framework to highlight key leverage points and specific actions that all business must utilize and deliver upon. This is a good introduction for any employee who is interested in and motivated to support climate action, but whose title and accountabilities may not be immediately and obviously relevant.

The Carbon Bankroll 2.0: From Awareness to Action

Building on the groundbreaking Carbon Bankroll 1.0 report, this report from Topo Finance explores the substantial climate impact of companies' banking and investment practices. It explains how - for many large businesses - corporate cash and investments are generating more emissions than all operations and supply chain activities combined; illuminates the central role that banking plays in determining our climate future; and provides valuable insights and step-by-step guidance for turning this awareness into action.

Aligning Corporate Value Chains to Global Climate Goals

This comprehensive paper from the Science Based Targets initiative (SBTi) can help you to understanding the challenges and opportunities with Scope 3 target setting. It explains the importance of Scope 3 target setting, outlines the challenges in setting and implementing Scope 3 targets, and assesses current Scope 3 target setting practices. It also explores the role of certification in addressing value chain emissions and provides a five-step approach for operationalising the proposed framework for managing value chain emissions towards net-zero transformation.

8 Steps to Enhance GHG Reporting: A Roadmap for Finance and Accounting Professionals

This guide by the International Federation of Accountant (IFAC) and We Mean Business Coalitions (WMBC) can help ensure your organisation’s GHG accounting is timely, robust, and reliable. It covers eight practical steps your CFO and finance team can take to collect, manage, and disclose GHG data according to the latest international standards.

Guidance on Avoided Emissions: Helping business drive innovations and scale solutions towards Net Zero

There is a growing recognition of the need to scale climate solutions (e.g., products, services, technologies) in order to produce necessary system-wide change. In response, private sector sustainability claims are surging. Unfortunately, many of these claims are not credible. The World Business Council for Sustainable Development (WBCSD) and a host of multi-stakeholder collaborators have created this guide to help you to credibly account for avoided GHG emission stemming from your climate change-related solutions. The guide outlines a rigorous methodology for assessing these avoided emissions so that strategic decisions related to climate investments are better informed. It covers five areas: defining avoided emissions; leveraging avoided emissions; ensuring the contribution is legitimate; assessing avoided emissions; and reporting avoided emissions. These insights will be most useful to sustainability professionals, but will also have implications for other departments including finance, development, and communications.

Assessing the Benefits and Costs of Nature-Based Solutions for Climate Resilience: A Guideline for Project Developers

This report from the World Bank aims to help you make the case for investments in Nature-Based Solutions (NBS) for climate resilience. It provides a decision framework to cost-effectively quantify the benefits and costs of NBS. The frameworks includes a common set of six analytical steps and four guiding principles to help you value the benefits of NBS related to disaster risk, food production, tourism, recreation, biodiversity, health, and water quality. It also provides eight case studies to illustrate how these assessments works in practice. The framework will be useful to a number of departments that may be involved in developing NBS projects including sustainability, finance, strategy, R&D, and operations.

The Climate Drive

This platform by WBCSD features a number of tools that can support your organisation’s net zero transition. These include an Action Library that features tangible, high-impact actions and recommendations from peers, such as green energy options for your operations and ways to make use of Power Purchasing Agreements. There is also an online Readiness Check that helps you assess your current goals, policies, and practices relating to decarbonisation, and a Net Zero Guidebook designed to help you build and leverage your net zero knowledge. This set of practical resources will be most useful to sustainability teams coordinating decarbonisation plans and to the operations departments seeking decarbonisation solutions to implement.

The Ocean as a Solution to Climate Change: Updated Opportunities for Action

This detailed report, produced by the High Level Panel for a Sustainable Ocean Economy (Ocean Panel), can help change agents understand the range of available and scalable ocean-based climate solutions. It highlights current and emerging opportunities to reduce greenhouse gas emissions in ocean-based sectors, including ocean-based renewable energy, food, carbon capture and storage, and more. It also outlines how the technology and infrastructure needed to implement these solutions can be financed within the unique context of each ocean-based sector.

The Low Carbon Lifestyles Wheel: Behaviors, Barriers, and Benefits

This paper from Futerra, BEworks, and WBCSD can help you promote the adoption of lower-carbon lifestyles. It is based on an “Action Wheel” framework that presents four categories of individual-level action: transportation, housing, diet, and purchases. Each category is broken down into outcomes, such as “Live car-free” or “Local Food”. Each of these outcomes is then further divided into specific actions. The paper also provides guidance on addressing the many potential barriers to each action. This practical tool will be useful to anyone seeking to foster sustainability-related behaviour change among employees.

Blue Ambition Loop: Achieving Ambitious 2030 Ocean-Climate Action

This brief produced by the UN High-Level Climate Champions group can help raise your awareness of ocean-based climate solutions and the role of businesses and other non-state actors in applying them. It provides a snapshot of commitments and actions being taken on six topics: ocean ecosystems conservation, marine transport, ocean energy, ocean food, ocean tourism, and ocean finance. This resource will be most useful to sustainability and supply chain practitioners.

The “No-Excuse” Opportunities to Tackle Scope 3 Emissions in Manufacturing and Value Chains

This white paper from the World Economic Forum provides a practical road map that can help you to accelerate your Scope 3 emissions reduction efforts. Published as part of the Industry Net Zero Accelerator Initiative, it explains the "what, why, how" of Scope 3 emissions; highlights key challenges to acceleration Scope 3 decarbonisation; and highlights twelve "no-excuse" opportunities for tackling these emissions across four action levels: the company level, the value chain, industrial systems, and broader society. These opportunities address both the Scope 3 calculation and abatement aspects and are complemented by 18 real-world case studies from early movers.

The State of Carbon Dioxide Removal: A global, independent scientific assessment of Carbon Dioxide Removal

This comprehensive report is a global assessment of the state of progress of carbon dioxide removal (CDR) and the gap we need to close to sustainably limit temperature increase in line with with the Paris Agreement. It explains what CDR is and why it is necessary for; explains patterns in investment, innovation, and expansion within the field of CDR; provides Paris-consistent CDR scenarios; explores key topics such as monitoring, reporting, and verification; and more. This report will be particularly beneficial to sustainability professionals and senior leaders who are exploring CDR of the voluntary carbon market.

The Climate Action Monitor 2024

This annual flagship report from the International Programme for Action on Climate (IPAC) can help you understand country-level trends and progress on climate action, as well as the costs of climate impacts across 51 OECD and OECD partner countries. The first section looks at how far countries are from achieving national and global GHG mitigation objectives, and it finds that countries must increase their ambitions significantly. The second section shows that extreme weather is becoming the norm at great cost, outlining population exposure to economic losses from heat, fires, storms, and floods. The third and final section provides a snapshot of key developments in climate policies in 2023 and shows that national climate policy action increased from 1% in 2022 to 2% in 2023, but is well short of the 10% average expansion between 2010 and 2020. This national-level overview offers useful context for both sustainability practitioners and business leaders.

Offsetting, Insetting, and Carbon Markets

The Core Carbon Principles

The Core Carbon Principles (CCPs) are a global benchmark that provide a credible and rigorous means of identifying high-integrity carbon credits. The CCPs were created by the Integrity Council for the Voluntary Carbon Market (ICVCM) to help standardise the quality of carbon credits sold on the voluntary market, and were developed through global cooperation from hundreds of key stakeholders and organisations throughout the voluntary carbon market. These 10 principles can help your company to better assess the quality of carbon credits and to ensure that your purchases are having real and verifiable impact on the climate.

The ICVCM has also created a guidebook that features a summary for decision-makers, which presents their assessment framework; their recommended assessment procedure; and an overview of the CCPs and their implementation through the assessment framework.

Oxford Principles for Net Zero Aligned Carbon Offsetting (revised 2024)

The Oxford Principles can help improve the emissions reduction outcomes of your carbon offsetting strategy. The Principles focus on four main elements for credible net-zero aligned offsetting:

Cut emissions, ensure the environmental integrity of credits used to achieve net zero, and regularly revise your offsetting strategy as best practice evolves

Transition to carbon removal offsetting for any residual emissions by the global net zero target date

Shift to removals with durable storage (low risk of reversal) to compensate any residual emissions by the net zero target date

Support the development of innovative and integrated approaches to achieving net zero

It also defines key terms and targets and explains types of projects available in today's carbon markets.

Claims Code of Practice: Building integrity in voluntary carbon markets

Recent questions about the credibility of voluntary carbon credits threatens their potential to fill financing gaps for climate mitigation. In response, the Voluntary Carbon Markets Integrity initiative (VCMI) has worked with existing standard-setters to create a code of practice that brings clarity to what a high quality credit looks like.

The Claims Code can help businesses make credible use of carbon credits in their climate commitments. The Code provides a practical, detailed, 4-step process: 1) Comply with the Foundational Criteria, 2) select a VCMI Claim to make, 3) meet the required carbon credit use and quality thresholds, and 4) obtain third-party assurance following the VCMI Monitoring, Reporting & Assurance (MRA) Framework. The guidance will be most useful to sustainability teams or anyone involved in purchasing credits from the voluntary carbon markets.

Reforming the voluntary carbon market

This white paper from Compensate is a good starting point for better understanding the voluntary carbon market and the steps required to achieve greater impact with carbon capture projects. It explains the current state of the market and highlights the most common flaws in carbon capture projects. It also introduces Compensate's project evaluation criteria, and explains how to apply it in practice.

The Role of Natural Climate Solutions in Corporate Climate Commitments: A Brief for Investors

Nature-based carbon offsets - also known as natural climate solutions (NCS) - can be an effective part of a company's mitigation efforts. However, it can be difficult to know where to begin, or how to exercise due diligence to ensure that the solutions you support are credible. This brief provides introductory guidance for institutional investors on the use of NCS in corporate climate strategies. It can help you to better understand the role of natural NCS for pursuing net-zero emissions, and how to better evaluate the quality of nature-based carbon credits.

A Practical Guide to Insetting

Insetting refers to a company offsetting its emissions through projects that avoid, reduce, or sequester carbon within its own value chain. It is an opportunity for businesses to link emissions and carbon sequestration to their sourcing landscapes. This guide from the International Platform for Insetting shares insights and provides recommendations that will help you to transform your supply chain for a resilient, regenerative, net zero carbon future that values and protects nature. The guide was created specifically for insetting practitioners and stakeholders that want to learn more about the concept, and it highlights lessons and opportunities for realising the full potential of insetting.

A buyer's guide to high-accountability MRV

Carbon180 has created a simple matrix to highlight the difference between high-accountability and low-accountability actions related to measuring, monitoring, reporting, and verifying (MMRV) the results of carbon removal projects. This is a good starting point for senior leaders that are exploring carbon offsetting as part of their organisation's mitigation strategy and want to build accountability and trust with carbon removal project developers.

A Buyer's Guide to Natural Climate Solutions Carbon Credits

This guide produced by the Natural Climate Solutions Alliance, WBCSD, and BCG is designed to help companies select and procure high-quality carbon credits on the voluntary carbon market. It focuses specifically on natural climate solution (NCS) credits, which are intended to support carbon reduction while also providing co-benefits for communities and biodiversity. Going step-by-step, the guide outlines how to integrate NCS carbon credits into your climate strategy. This includes setting procurement criteria, finding sources, purchasing, and reporting credible claims. The guidance will be most useful to sustainability and procurement teams.

How to Kick-Start the Carbon Removal Market: Shopify’s Playbook

Shopify spent the past year exploring and growing the carbon removal market, and they created this playbook to share their journey and learning outcomes. This guide provides experiential insights, tangible steps, tools, and templates that will help you to fund the right types of climate solutions; be flexible with purchases to maximise impact; and identify the most promising carbon removal companies. If your company wants to contribute to a net zero future through carbon removal but is leery of costly mistakes, we recommend this as early essential reading.

Carbon removal and avoidance: a buyer’s guide

This concise guide from Watershed (a carbon credit marketplace) can help you to identify credits that have meaningful impact. It begins by explaining the nuanced yet important difference between carbon avoidance and carbon removal. It then outlines the key features of high-quality avoidance projects, and describes two main categories of carbon removal: “nature-based solutions” and “permanent carbon removal solutions." This guide may be useful as a quick introduction to offsetting for sustainability and finance departments that are looking to purchase offsets of the first time.

How to choose carbon offsets that actually cut emissions

This article from MIT Sloan will help you to understand whether or not the carbon offsets you purchase are actually cutting emissions. It outlines a simple four point framework that assesses if the offset is Additional, Verifiable, Immediate, and Durable (AVID+). Each point must be met for an offset to be credible. When these minimum requirements are met, offset purchasers should also look for projects with additional societal benefits (the “plus” of AVID+). This framework will be most useful to sustainability teams and anyone else involved in purchasing carbon offsets.

Insetting and Scope 3 climate action: applying and accounting for Natural Climate Solutions (NCS) in land sector value chains

This brief from WBCSD can help you to better understand the emerging practice of insetting is and why it is especially important in land sector value chains. The paper defines insetting; outlines how the GHG Protocol’s draft guidance is accounting for insets; and describes the business case for insetting and the need to harmonise insetting definitions and accounting. The guidance will be most useful to sustainability practitioners and supply chain managers working in agriculture and forestry, or in other industries with significant land use.

Mind the Gap: How Carbon Dioxide Removals Must Complement Deep Decarbonisation to Keep 1.5°C Alive

This briefing paper from the Energy Transitions Commision (ETC) will help you to understand that carbon removals must play a role in climate change mitigation strategies in addition to rapid decarbonisation, starting today.

The paper provides a comprehensive description of how ambitious development of cardon dioxide removal (CDR) solutions - combined with ambitious decarbonisation - could prevent 'overshoot' of the 1.5°C carbon budget by 2050. It covers climate targets and the implications for carbon budgets; emissions reduction scenarios and the size of the overshoot gap; types of CDR and their feasible scale by 2050; the risks involved for each type of CDR and how to manage them; an examination of who should pay for removals, and how; and the actions needed in the 2020s to ensure subsequent removals occur at the necessary pace and scale.

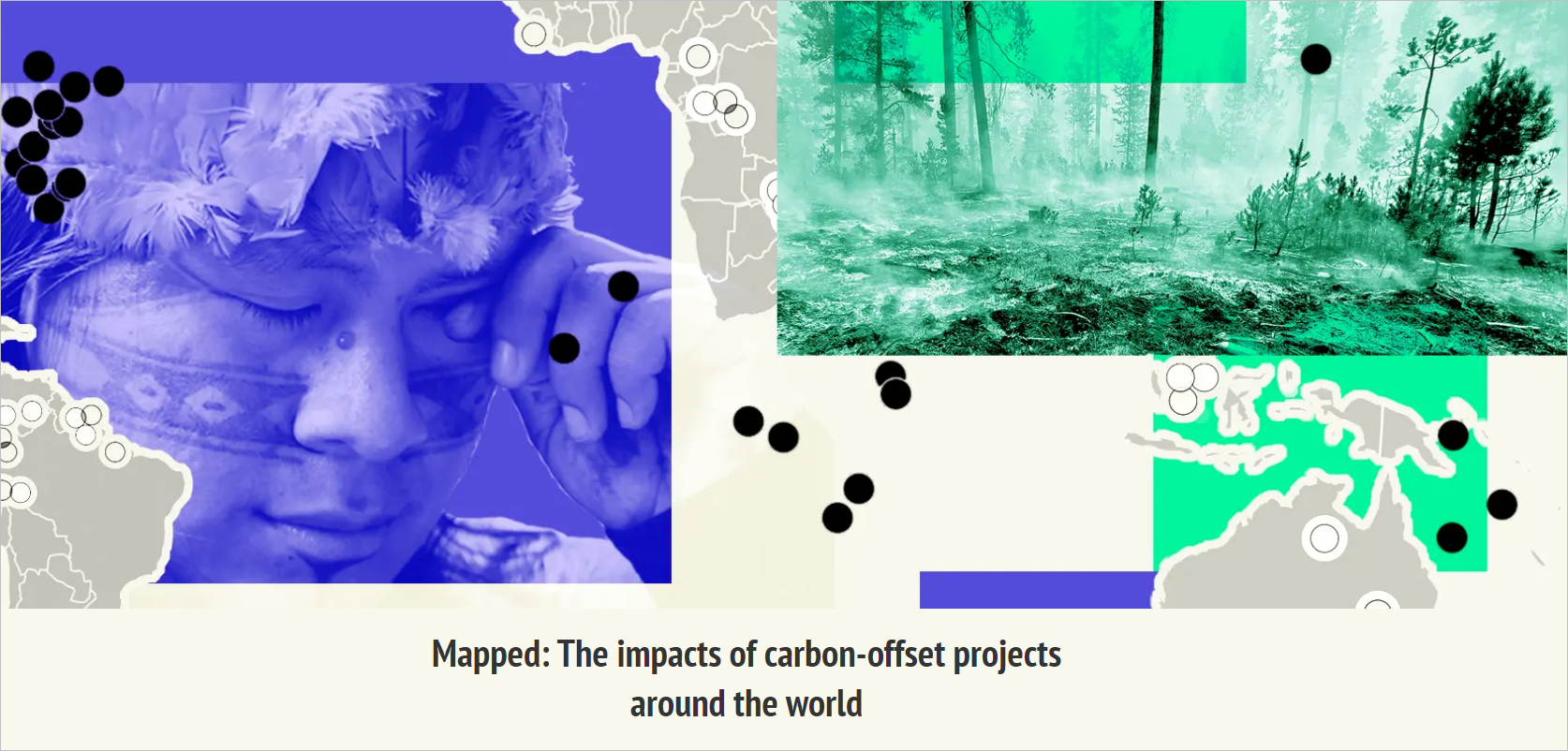

Mapped: The impacts of carbon-offset projects around the world

This tool created by Carbon Brief maps out the locations of carbon offset projects that have created negative impacts. It can help you to understand how these negative impacts manifest, the locations where they are most likely to occur, and their prevalence. The map also highlights the tendency for offset measurements to be overestimated. This resource provides important insights for community relations teams, sustainability teams, and for anyone involved in procuring offsets.

The Evolution of Corporate Climate Commitments: The Role of Carbon Credits in Achieving Net Zero, Carbon Neutrality, and SBTi Targets

New and increasingly sophisticated carbon reduction targets have emerged as organizations look to aggressively reduce their emissions. This resource from 3Degrees will help you to understand the difference between three increasingly commonly climate-related targets: carbon neutrality, science-based targets, and net zero emissions. The guide also highlights solutions for addressing unabated or residual emissions.

Being Positive about Negative Emissions: Incorporating carbon removals into net zero strategies

Earth is expected to surpass the 1.5 °C degree warming threshold within a decade. Scaling up greenhouse gas (GHG) removals are one approach to mitigate this global risk. This report written by the Coalition for Negative Emissions provides an overview of emerging GHG removal industries and how your business can play a role scaling them. It argues for the importance of GHG removals in limiting global warming and outlines key processes for removing emissions from the atmosphere. It then explains why GHG removal is essential for hard-to-abate emissions, and outlines why corporate net zero plans should include GHG removals.

Voluntary Carbon Markets: Potential, Pitfalls, and the Path Forward

This guide can help you develop a grounded understanding of the controversial topic of carbon credits and their role in mitigating the climate crisis. Developed by the Climate Crisis Advisory Group (CCAG), an independent NGO whose members include leading earth system scientists such as Johan Rockstrom and Mark Maslin, the report examines the current state of Voluntary Carbon Markets (VCMs), exploring how carbon credits are used and why they have suffered a loss of confidence. The report is then divided into five numbered sections: the first, “Market basics," explains how VCMs work and their theoretical power to shift money directly to where it is most needed, and sections two through five break down the specific issues and challenges with VCMs. The final section also provides recommendations for ensuring that scientific rigour and transparency are built into VCMs so that their potential can be realised in the future. This resource offers a clear, comprehensive, and balanced view of carbon credit usage that will benefit a broad range of sustainability professionals, and especially those involved in purchasing carbon credits or developing carbon removal projects.

State of the Voluntary Carbon Market 2024

This report from Ecosystem Marketplace can give you an overview of the global voluntary carbon market from a carbon market industry perspective. Using interviews and other data collected from project developers and credit resellers, it reviews market activity for the past year, such as trends in supply and demand across regions and credit types. It also looks ahead to important developments shaping the future of the voluntary carbon market. This resource will be especially beneficial to sustainability practitioners, and anyone involved in purchasing carbon credits.

State of the Voluntary Carbon Market: 2024

This concise report from Carbon Direct can help you to better understand key trends and developments in the voluntary carbon market and the carbon dioxide removal (CDR) market. This resource will be especially beneficial to carbon credit purchasers, carbon project developers, and policymakers.

The Climate Action Protocol: Navigate the Complexity To Make Confident Climate Claims

This resource from Climate Impact Partners can help you to navigate the growing range of frameworks and guidance on climate action claims. The protocol compares Climate Impact Partners’ CarbonNeutral certification; ISO’s 14068 Carbon Neutral Standard; ISO’s Net Zero Guidance; SBTi’s Net Zero Standard; and VCMI’s Carbon Integrity Claim. It also provides tools to compare and contrast requirements in order to make the right choice for your business. This resource is a good starting point for sustainability professionals that want to build a better understanding of these initiatives.

Nature-based Solutions for corporate climate targets

This guide by the IUCN can help you understand what Nature-based Solutions (NbS) are and how they contribute to net zero and nature positive goals. It has three sections that cover the role of NbS in climate change mitigation, corporate climate strategies, and achieving societal net zero. It is also features illustrative graphics. This guide will be most useful as an overview or introduction to NbS for sustainability professionals and others.

Carbon Offsets Are More Popular than Ever, and That’s a Problem

The demand for carbon offsets has never been greater, and their legitimacy as an effective tool for stopping climate change has never been more tenuous. This is the first entry in a three-part series that explains carbon offsets and their viability as a credible solution for reducing emissions. In this instalment, we unpack carbon offsets and carbon credits and explain why the market for carbon offsets is growing.

Buyer, Beware: How to Navigate the Carbon Offset Market

This is the second entry in a three-part series about carbon offsets and their viability as a credible solution for reducing emissions. In this instalment, we look at the most common issues with carbon offsets (with a focus on nature-based offsets) and highlight key considerations and actions you can take to better ensure that your offset investments are effective and credible.

Enter, Insetting: Supporting Carbon Reduction in Your Value Chain

In the third and final instalment of our blog series on carbon offsets, we offer an alternative to offsetting: insetting your emissions within your own value chain. We highlight how carbon insetting can help you reduce your carbon emissions profile while also supporting your value chain members and advancing climate justice.

Guidelines for High Integrity Use of Carbon Credits

80% of the world’s largest companies have not yet set climate targets, and most that have targets are off track. As a result, there is a widening gap between the 1.5°C pathway and climate action. This guide by the International Emissions Trading Association (IETA) argues that voluntary carbon market (VCM) investment is essential to keeping companies’ targets on track and closing the emissions gap. The guide provides six guidelines designed to help you make carbon credits part of a decarbonisation strategy: 1) demonstrate alignment with the Paris agreement; 2) quantify and disclose emissions; 3) establish a net zero pathway; 4) use carbon credits in addition to emissions reductions; 5) vet credit integrity; and 6) disclose the use of credits. This resource will be most useful to sustainability practitioners and strategy teams.

Criteria for High-Quality Carbon Dioxide Removal

This report by Carbon Direct and Microsoft can help you understand what high-quality carbon dioxide removal (CDR) project criteria look like. The report presents a common set of shared principles that are intended to help characterise high-quality CDR projects and provides specific criteria for eight different types of CDR, including forestation, soil carbon, enhanced rock weathering, and direct air capture. Each section covers social criteria; environmental criteria; additionality; measurement; durability; and leakage. This resource will be most useful to sustainability and procurement practitioners engaged in procuring CDR.

Natural Climate Solutions for the Voluntary Carbon Market: An Investor Guide for Companies and Financial Institutions

This guide from ERM, WBCSD, and the Forest Investor Club provides insights that can help you to better identify and invest in natural climate solution (NCS) projects. It highlights the questions that investors should ask; common challenges they may face; and examples of best practice across key stages in the NCS investment process, including planning for investment, due diligence integrity evaluations, data collection, and disclosure.

Global Carbon Markets Hub

This public database of carbon market information can help you better understand voluntary carbon market trends and make more informed decisions. Created by Ecosystem Marketplace (EM) to increase market transparency, the database features four sections available to unregistered users. The ‘Home’ and ‘Categories’ sections provide data on carbon credit volume and price data across time, geographies, and countries. The ‘EM Taxonomy’ section offers an overview of the many types of carbon credit projects, grouping them into eight broad categories, each featuring a number of project sub-categories. Lastly, the ‘Projects’ section contains a list of 20,000+ carbon credit projects from over 100 countries. This listings include information on project name, category, country, third-party standard, and in some cases the quantity of credits issued and retired. This resource will be useful to those involved in purchasing carbon credits, including sustainability, procurement, and finance teams.

The Land Gap Report

This report from the Climate Resource can help you understand how national net zero climate commitments rely on unrealistic amounts of land-based carbon removal. While it focuses on the climate mitigation approach of national governments, these insights are also relevant to business. It shows that there is generally a misguided emphasis on offsetting climate impacts, primarily through tree planting, while the irreplaceable value of primary forest ecosystems is neglected. Alternatively, it emphasises that protecting and restoring primary forests is the most effective land-based mitigation action. It also highlights that mitigation activities lack attention to the power relations between Indigenous Peoples and local communities living on the lands involved. Finally, it demonstrates that transitioning from emissions-intensive industrial agriculture to agroecology is essential to advancing climate change adaptation and mitigation. These insights will be useful to anyone involved in climate mitigation activities, such as sustainability, finance, and strategy teams.

Renewable Energy Development

Including adopting and encouraging renewable energy options.

Just Transition and Renewable Energy: A Business Brief

This business brief from the United Nations Global Compact outlines how your business can support public Just Transition policies. The authors acknowledge that business has a key role to play in ensures that the transition to the low carbon economy is just. The brief provides ten recommendations for how business can support the transition through their policy advocacy. This guidance will be most useful to your Government Affairs or Public Policy team.

Fossil Fuels in Transition: Committing to the phase-down of all fossil fuels

This in-depth, scenario-based report from the Energy Transitions Commission (ETC) can help you understand what technologies and supporting policies are needed to decarbonise the global economy. It highlights the policies required to reduce fossil fuel demand; the role of different clean energy technologies in replacing fossil energy; and the role of carbon capture and removals. There is also a sectoral breakdown outlining where emissions reductions are most needed. This high-level overview of a global energy transition will be most useful to business leaders, strategy teams, and sustainability practitioners seeking to find out how their organisation fits in the global transition towards renewable energy development.

Global Energy Alliance for People and Planet

The Global Energy Alliance for People and Planet (GEAPP) is an alliance of philanthropy, local entrepreneurs, governments, and technology, policy, and financing partners that support a clean energy transition and ensuring universal energy access. They have produced a range of reports to support your understanding of key renewable energy topics, such as how the power system can be transformed in energy-poor countries and the job creation potential from a green power transition. Their flagship report, Powering People and the Planet, is a good resource for understanding the global challenge of ending energy poverty and the steps required to ensure a just energy transition.

The Clean Energy Buyers Institute (CEBI)

The Clean Energy Buyers Institute (CEBI) is a non-profit organisation that produces and curates resources that can help you understand innovative clean energy market solutions. Their resources include toolkits, explainers, and research on topics such as advancing grid decarbonisation and clean energy procurement. They have also curated a range of relevant resources. This platform will be most useful to Procurement, Operations, and Sustainability teams, or anyone responsible for energy purchasing.

Building Trust through an Equitable and Inclusive Energy Transition

This white paper from the World Economic Forum can help you understand why addressing the socioeconomic implications of the energy transition is essential for its viability. Divided into four parts, the paper outlines the complexities involved in advancing an equitable and inclusive energy transition; highlights the emerging signs of an unjust transition; identifies the underlying challenges of building trust and finding common ground between diverse stakeholders; and explores how regulations and effective capital mobilisation can enable workforce reskilling, distributed renewables development, and low-carbon innovation. These insights will be most useful to business leaders investing in the energy transition.

Strategies for Affordable and Fair Clean Energy Transitions

This comprehensive, evidence-based report from the International Energy Agency (IEA) offers a big-picture perspective on the costs, benefits, opportunities, and challenges of a rapid clean energy transition. The report explains how a clean energy future would be more affordable while also detailing the challenges that come with financing the transition at the level of government, households, and the private sector. It explores the policies needed to share the costs of the transition fairly, examines the risk of price shocks (drawing on historic examples and potential future risks), and provides guidance on how to safeguard against shocks that may compromise the affordability and fairness of the energy transition. These insights have important implications that will be most relevant to business leaders, strategy teams, and sustainability teams.

Tracking SDG7: The Energy Progress Report, 2024

This comprehensive progress report by the International Energy Agency (IEA) and other agencies can help you understand where progress has been made and where it is off track to meet the 2030 goal of SDG 7. The first five chapters review progress trends across key indicators (access to clean fuels and technologies for cooking, renewables, energy efficiency, and international public financial flows to developing countries in support of clean energy); chapter six provides an outlook for SDG 7; and chapter 7 provides and indicators for tracking progress towards SDG 7 across targets. This resource will be most useful to sustainability practitioners interested in a statistical overview of global trends in energy and their alignment with international climate and development goals.

Just Transition Guide: Indigenous-led Pathways Toward Equitable Climate Solutions and Resiliency in the Climate Crisis

The global transition towards renewable energy is an important opportunity for Indigenous Communities to choose their own future. This resource from Sacred Earth Solar (SES) and others can help you understand how renewable energy projects can enable a Just Transition for Indigenous Communities. It explains the current challenges related to the Canadian energy and electricity systems and how they can be improved to support decentralised renewable energy projects. It showcases different pathways for developing community-based renewable energy systems such as solar, wind, small-scale hydro, and explains key considerations and learnings from communities that have already implemented them. This resource also explores other community solutions for a Just Transition, such as, food sovereignty, and reimagines how government policy can support these efforts. The lessons here will be most useful to sustainability and community relations teams whose organisations work with - or impact - Indigenous communities.

World Energy Outlook 2024

This annual report from the International Energy Agency can help you better understand trends in global energy use. Based on three long-term scenarios outlined, it explores how different energy futures might impact energy security, affordability, and sustainability. In all scenarios, human-caused emissions peak before 2030 and then decline at rates of 1%, 4%, and 15% per year. These trajectories lead to corresponding average temperature increases of 2.4 °C, 1.7 °C, and 1.5 °C above pre-industrial levels by 2100.

It is important to note that these scenarios are based on many normative assumptions, and that warming is happening faster than expected; we have already exceeded 1.5 °C for more than a year. Further, these projections do not account for increasing natural emissions resulting from earth system destabilisation. That said, this report does offer useful macro-level considerations related to how geopolitical tensions, energy deployment, and electricity demand might affect the energy transition. While the full report is 398 pages long, we recommend strategy and sustainability practitioners review the executive summary.

Sustainable Power Policy Tracker

Banks have a major role to play in supporting power decarbonisation, either by directing financial flows to new sustainable power systems or ceasing financing of fossil fuel expansion and supporting phase-out. This tool can help you to better navigate the sustainable power policy landscape. Created to ensure the financial sector is adopting effective sustainable power policies to forcefully contribute to the 1.5°C climate goal, it tracks the commitments adopted by the top 60 banks worldwide regarding their support for sustainable power, including their targets for supporting sustainable power supply; for financing new sustainable power capacity; and for reporting on progress and other aspects.

Coal Policy Tracker

This tool can help you to better navigate the coal policy landscape. Created to ensure the financial sector is adopting effective coal policies to forcefully contribute to the 1.5°C climate goal, it assess over 500 institutes against seven criteria, including the exclusion of both new coal projects and the expansion of existing coal mines, plants, and infrastructure.

Oil & Gas Policy Tracker

This tool can help you to better navigate the oil and gas policy landscape. Created to ensure the financial sector is adopting effective oil and gas policies to forcefully contribute to the 1.5°C climate goal, it assess over 440 institutes against seven criteria, including the immediate exclusion of financial services dedicated to oil and gas projects as well as phase-out commitments.

Renewable energy certificates threaten the integrity of corporate science-based targets

This paper explains how the credibility of corporate science-based targets can be undermined by the use of renewable energy certificates (RECs). It outlines how the widespread use of RECs by companies have led to overestimates of mitigation impacts, and it argues that revised GHG accounting guidelines are needed to meet the 1.5 °C goal of the Paris agreement. The key findings of this paper will be most useful to sustainability practitioners, CSOs, and other executives involved in setting climate goals.

Site Renewables Right

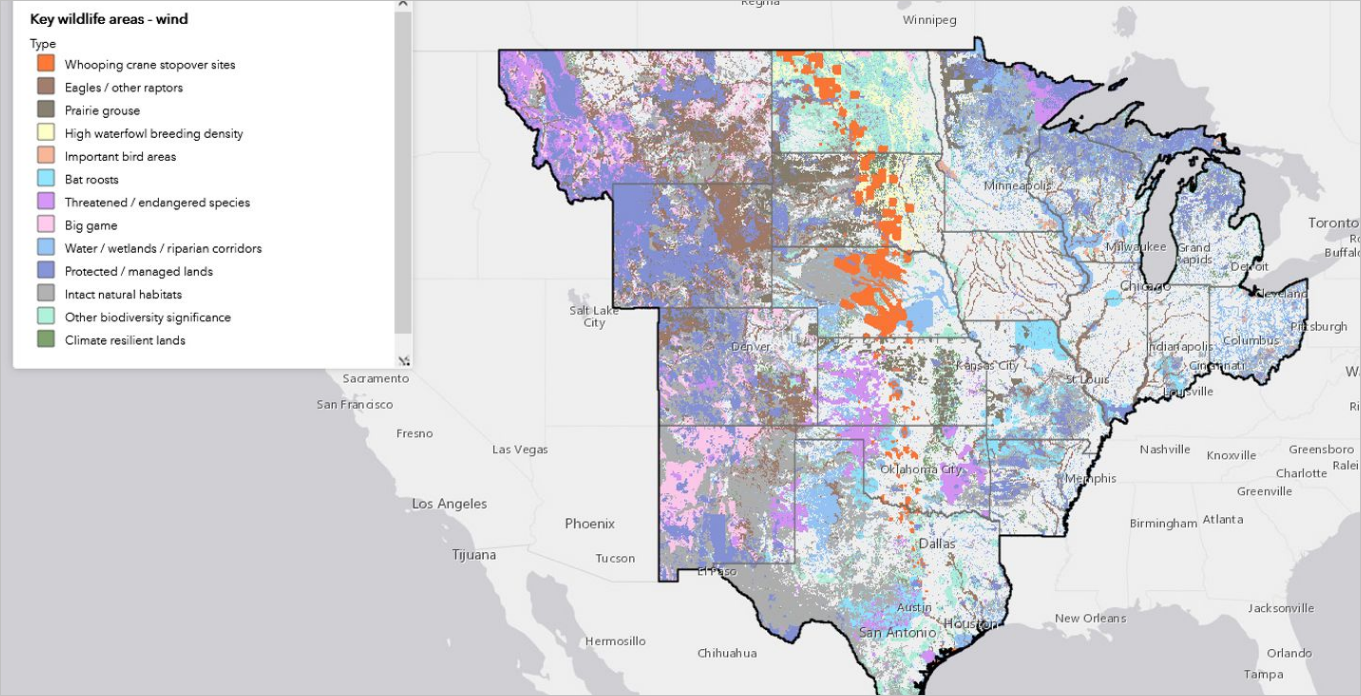

This article by The Nature Conservancy introduces their Site Renewables Right Map. This interactive web map of the central United States combines more than 100 layers of engineering, land-use, and wildlife data to help you understand where wind and solar development will have a lower impact on wildlife. This information is intended to empower companies and communities to accelerate the deployment of renewable energy while protecting nature. This tool will be most useful to those involved in developing or procuring renewables energy, such as project development, engineering, procurement, and sustainability teams.

Building Benefit: Four steps to mitigate renewable energy’s environmental downsides

Although renewables are needed in growing numbers to meet climate goals, the environmental externalities associated with raw material extraction, manufacturing, and end-of-life disposal are likely to become more pronounced. This briefing from the ERM Institute identifies four steps that can limit the negative impacts of renewables growth on the environment and societies: opting for green production inputs and processes, introducing circular alternatives, minimising footprints, and considering wildlife from the start. The briefing identifies the benefits for taking action on each of these steps and provides practical solutions for achieving them.

Resourcing the Energy Transition: Principles to Guide Critical Energy Transition Minerals Towards Equity and Justice

The demand for critical minerals is set to nearly triple by 2030 as the world transitions from fossil fuels to renewable energy. Yet, without proper management, the demand for critical minerals threatens to perpetuate commodity dependence, exacerbate geopolitical tensions and environmental and social challenges, and undermine efforts towards the energy transition. This guide from the Panel on Critical Energy Transition Minerals can help you to do your part to ensure the just and equitable management of sustainable, responsible, and reliable value chains for critical energy transition minerals. It highlights seven voluntary guiding principles for grounding the renewables transition in justice and equity, building on existing norms, commitments, and legal obligations outlined in UN texts. It also provides a number of actionable recommendations to help you embed and maintain these guiding principles across critical energy transition mineral value chains.

Playbook of Solutions To Mobilize Clean Energy Investment in the Global South

This resource from the World Economic Forum can help you understand how to unlock clean energy investments in emerging economies. It shows how common challenges in the Global South - such as lack of credit ratings or capital market depth - can be overcome. These solutions are laid out in the three sections: policy measures, finance mechanisms, and de-risking tools. There is also a large set of accompanying case studies highlighting where and how these tools have been applied. This practical tool will be most useful to investors and corporate finance teams.

Exploring shared prosperity: Indigenous leadership and partnerships for a just transition

This report from Indigenous Peoples Rights International (IPRI) and the Business & Human Rights Resource Centre can help you understand why the benefits of the energy transition must be shared with Indigenous Peoples around the world. The first section outlines the growing trend of benefit-sharing between business and Indigenous peoples in recent decades. It then explains the legal foundations for benefit-sharing, how it can create positive impact, and where it can go wrong. It also highlights co-ownership as an emerging model for benefit-sharing. The second section outlines the role of both government and companies in enabling the conditions for fair and equitable benefit-sharing. The third and final section offers project-level guidance on identifying and implementing benefit-sharing with a focus on equity co-ownership agreements. This resource will benefit professionals at any organisation whose activities affect the ancestral lands, territories, and resources of Indigenous Peoples, and will be widely applicable to project developers as well as sustainability, finance, legal, risk, and community relations teams.