Biodiversity

Description

Including habitat loss and degradation; species loss, including reductions in population, species distribution, traits, and diversity between species and of ecosystems.

Share this Subissue on:LinkedIn

Resources

Understanding the Basics of Biodiversity

The Economics of Biodiversity: The Dasgupta Review

This global review on the economics of biodiversity calls for changes in how we think, act, and measure economic success in order to protect and enhance our prosperity and the natural world. The review thoroughly explains the foundation of the biodiversity crisis, and includes key recommendations for reversing the human-caused decline in biodiversity, such as expanding and improvement of protected areas; increased investment into nature-based solutions; the creation or improvement of policies to eliminate damaging consumption of natural assets; the incorporation of natural capital accounting; and proper valuation of ecosystem services into all national accounting systems. This comprehensive deep-dive is a key reference point for sustainability professionals that want to account for nature in decision-making.

Living Planet Index

The WWF's Living Planet Index (LPI) is a measure of the state of the world's biological diversity based on population trends within the animal kingdom. Adopted by the Convention of Biological Diversity (CBD), this resource provides data a variety of sources for thousands of species. Whether you are evaluating current or future potential strategic risks from biodiversity decline, or simply seeking to build your understanding of the state of biodiversity, this resource is a good starting point to build your knowledge of systemic pressures and threats to biodiversity, socioecological trends, and other insights on how "conservation intervention" can promote species recovery.

WWF also publishes a biennial Living Planet Report, which provides a comprehensive assessment of the health of the planet. The report measures the average change in population sizes of more than 5,000 vertebrate species, and the latest updates suggests a decline of 73% between 1970 and 2020. It also features comprehensive information on measuring nature's decline; tipping points; global goals and progress; and sustainable solutions, such as those related to nature conservation, green finance, and changes to our food and energy systems.

A Simple and Visual Definition of Biodiversity

This article written by the Network for Business Sustainability explains the three levels of biodiversity (genetic, species, and ecosystems) in simple terms, and illustrates the importance of biodiversity with a coral reef ecosystem case study. This explainer will be most useful to business leaders and to anyone interested in clarifying basic nature concepts.

Biodiversity Risk Filter

Joining the Water Risk Filter in WWF's Risk Filter Suite, the Biodiversity Risk Filter was created to help you understand, explore, assess, and respond to biodiversity risks across your operations, value chains, and investments. This free tool uses 50 annually-updated data layers that collectively provide a global, holistic picture of biodiversity-related risk. This includes information on species and ecosystems, protected areas, and the most important pressures on biodiversity such as deforestation, habitat destruction, pollution, and land use change.

A Biodiversity Guide for Business

This report from WWF can help you to identify, assess, and address biodiversity risks and opportunities that come from conserving, using, and restoring biodiversity in a sustainable way. It highlights the impact that industries such as agriculture, extractives, land development, and energy production have on biodiversity, as well as their dependencies on robust and resilient biodiversity and ecosystems. The guide also provides a biodiversity stewardship approach to help you get started.

Business for Nature

Business for Nature is a global coalition that brings together businesses and conservation organisations to advance corporate actions and government policies that reverse nature loss. They have outlined four high-level business actions that your business can take to signal that it is making meaningful contributions to creating a nature-positive world. They also provide case studies; resources to support nature-related advocacy and communications; and summaries of new and relevant frameworks, conventions, agreements, and more. Business for Nature is a good starting point for leaders and sustainability professionals who want to better acquaint themselves with nature-related policy trends, corporate actions, and talking points.

Nature in the balance: What companies can do to restore natural capital

This resource can help you to better understand the scope and scale of actions that corporations must take to protect, manage, and restore nature, thereby preserving Earth as a "safe operating space for humanity." The report outlines the case for a nature-positive approach to business; outlines the actions required to live within the planetary boundaries, and the outcomes it would achieve; and identifies key opportunities that specific industries must seize to reduce their impacts on nature. It also provides a four-step roadmap for action, including credible investments, initiatives, and innovations that companies can pursue to achieve nature-positive commitments.

Global biodiversity is in crisis, but how bad is it? It’s complicated

This article is a good primer on the pace and severity of biodiversity decline and the impacts this decline is having on our world. The article explains the concept of a global threshold for biodiversity loss; the concept and importance of genetic diversity; the realities of regime shifts; and the importance of radical action to preserve the remaining integrity of our biosphere.

Nature for boards: A primer

This resource from Pollination - in collaboration with Chapter Zero and Korn Ferry - provides a good summary of key nature topics and practical guidance that can help you to support environmental resilience. Created for non-executive directors and board members, this guide explains what future-facing governance and leadership look like in the context of nature-related risks and opportunities; nature fundamentals for businesses; directors' duties and nature risk; understanding nature-related opportunities; and the steps directors should be taking now.

Setting Targets and Commitments

Taking a Credible Position on Nature

There is growing pressure on companies to publicly acknowledge the unprecedented nature loss we face, and what they plan to do to address it. To help them do so, we reviewed over 1,000 statements on nature loss, biodiversity, and ecosystem stewardship from a wide range of geographies and industries, and identified examples of how companies are explaining the issue of nature loss, linking the issue of nature loss to their strategy, and clarifying their commitments to protect and restore nature. We hope this guide is helpful to you in articulating your own credible position statement on protecting and restoring nature.

Science Based Targets

Building on the momentum of the Science Based Targets initiative (SBTi), the Science Based Targets Network (SBTN) is a collaboration of 45+ global non-profits and mission-driven organizations working together to develop guidance to set science-based targets for all of Earth’s systems. Science Based Targets has created a five-step target-setting framework that helps you to assess; interpret and prioritise; measure, set, and disclose; act upon; and track your science-based goals. They have also created sector-specific guidance and target monitoring for companies and financial institutions.

At present, Science Based Targets helps companies to develop their goals based on the latest science: SBTi specifically focuses on GHG emission reduction goals, and SBTN specifically focuses on nature positive goals, with target-setting guidance for land, biodiversity, and freshwater. Their respective websites provide comprehensive resources, cases, and support for taking credible action.

Guidelines for planning and monitoring corporate biodiversity performance

These practical guidelines from the IUCN can help business of all types develop strategic plans to manage their biodiversity impacts. It uses a four stage approach, including understanding your companies impacts; developing your strategy and goals; identifying a set of meaningful biodiversity indicators; and creating a plan to monitor performance. This is a good resource for sustainability teams, managers, and other professionals whose responsibilities include strategic planning and biodiversity-related reporting.

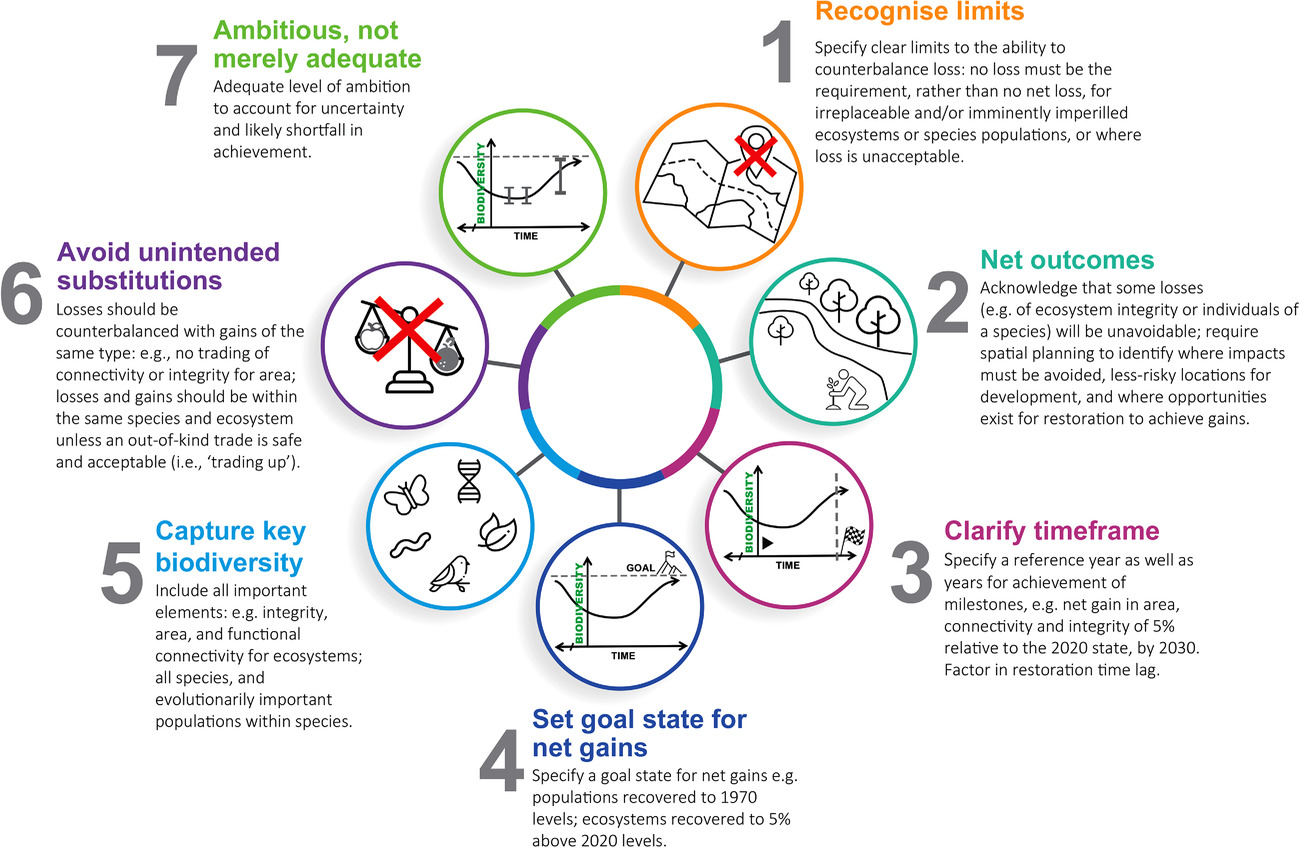

Setting robust biodiversity goals

The global biodiversity framework (GBF) that is being developed under the Convention on Biological Diversity intends to ensure that by 2050 humanity is 'living in harmony with nature'. However, the authors of this paper argue that the draft goals and targets - as they are currently articulated - do not specify explicit, measurable goals that can credibly achieve this outcome. This paper makes the case for distinct outcome goals for species, ecosystems, and genetic diversity, and it outlines seven general principles to underpin smart and effective net outcome goal-setting. These principles can help you to better understand the benefits and shortcomings of broad "net outcome" goals (such as "no net loss") and can support your process for creating and implementing credible biodiversity goals.

Healthy ecosystem metric framework: biodiversity impact

A growing number of companies have expressed the need for clear, standardised 'healthy ecosystem' metrics to demonstrate their progress towards reducing their impact on nature. To help business leaders and sustainability change agents take action on ecosystem decline, the Cambridge Institute for Sustainability Learning has developed a framework that provides a credible, science-based starting point for measuring ecosystem impacts from a contextual perspective. The metric provided is based on the impact of a company upon the quality and quantity of biodiversity, soil, and water, with clear information on how the metric was conceived and how it could be used.

A Cross-Sector Guide for Implementing the Mitigation Hierarchy

This guide from the Cross Sector Biodiversity Initiative and The Biodiversity Consultancy clearly defines the four steps of the mitigation hierarchy (avoid, minimize, restore and offset) and their application with regard to managing biodiversity throughout the life cycle of an extractive project. The guide offers practical measures for predicting and verifying biodiversity conservation outcomes over time, and provides insights into recording and comparing mitigation-related costs. If you are seeking to learn about the mitigation hierarchy and to understand your options for mitigating impacts from a contextual perspective, this guide is an excellent starting point.

Beyond 'Business as Usual': Biodiversity Targets and Finance

This report from the United Nations Environment Programme (UNEP) and the Natural Capital Finance Alliance (NCFA) was created to highlight the need for banks, insurers, and investors to set strong biodiversity targets. This resource can help you to understand why nature is important to financial institutions; which sectors have the greatest impact and dependence on biodiversity; and how to use this knowledge to inform biodiversity target-setting.

From Commitments to Action at Scale: Critical steps to achieve deforestation-free supply chains

The CDP is a not-for-profit charity that runs the global disclosure system for investors, companies, cities, states, and regions to manage their environmental impacts. In addition to their work on carbon and climate change, they have created a range of resources to help your company take action on deforestation. Their Global Forests Report is a good resource for helping change agents understand the scale, scope, and rigour of actions required to tackle deforestation so that they can better summarise and translate these findings for executives and boards. Building off previous CDP and Accountability Framework Initiative (AFi) analysis, this report highlights areas of progress and gaps in performance and provides insights that can help your company learn from the progress of industry peers. Each section of the report summarizes key elements of the Accountability Framework’s Core Principles and guidance followed by corresponding analysis of company performance using CDP data.

No net loss and net positive impact approaches to biodiversity

The objective of this report from the IUCN is to learn from the experiences of the extractive and infrastructural sectors and to propose an organizing framework for applying No Net Loss (NNL) & Net Positive Impact (NPI) approaches in other business sectors. Although written with the agriculture and forestry sectors in mind, this report will help you to understand the mitigation heirarchy and the ambiguity around NNL and NPI definitions and impact goals. The document also provides a framework for applying a Net Positive Impact approach, with step-by-step scenario schematics (including visuals) that will help you to better understand the applicability of the mitigation hierarchy to your organization's work.

Integrated Biodiversity Assessment Tool

This tool from the IBAT Alliance will improve your decision-making and access to markets by growing your understanding of local, national, and regional biodiversity risks and opportunities. IBAT provides comprehensive risk reports with data from the World Database on Protected Areas, the IUCN Red List of Threatened Species, and the World Database of Key Biodiversity Areas; combined, this information provides a comprehensive risk 'map' that will help you to align with international best practices. Although IBAT has a sliding subscription scale, there is an introductory option with free access to visual data maps and country profiles, as well as pay-as-you-go reports.

Corporate Action on Nature Loss: Key Trends

Nature is disappearing, harming people and business. In this blog, we explain what you need to know about nature loss, the TNFD, and taking credible action to protect and restore nature.

Beyond Target 15: Aligning Corporate Nature Actions to the Global Biodiversity Framework

The Global Biodiversity Framework (GBF) outlines 23 targets to achieve by 2030. To date, corporate action has been limited to target 15. This white paper from the Wildlife Habitat Council can help you understand how corporations can support many other GBF targets beyond target 15. To this end, it illustrates a number of on-the-ground corporate conservation actions. These include managing land to reduce biodiversity loss; restoring and conserving ecosystems; protecting species of concern; responsibly managing wildlife populations; controlling invasive species; and developing urban green spaces. For each action, it provides an explanation, identifies which targets it supports, and provides an example of a business that has applied the action. The paper concludes with a call to action for corporate landowners to ensure their nature-positive actions align with the targets of the GBF. This resource may be relevant to many functions, including sustainability, community relations, operations, and finance teams.

Understanding Deforestation

The Accountability Framework

This framework from the Accountability Framework initiative (AFi) features twelve core principles for building, strengthening, and supporting ethical supply chains. These principles serve as a guide for companies and others in setting, implementing, monitoring, and reporting on effective goals and commitments on deforestation, ecosystem conversion, and human rights in ethical supply chains. AFi has also developed operational guidance to help you put the core principles into practice; a self-assessment to help you with benchmarking your goals, policies, and practices against the framework; and other related tools and guides.

Deforestation-free finance: a guide on tools and frameworks for financial institutions

This report from WBCSD can help you understand how banks and investors can avoid financing deforestation. The report provides an overview of three key frameworks for assessing and disclosing deforestation risk exposure in your investment and lending portfolios, and reviews the assessment and data collection tools you can use to support this work. It also highlights tools for aligning with important global frameworks for nature, such as the Taskforce for Nature-Related Financial Disclosure (TNFD) and the Global Biodiversity Framework. This report will be most useful to sustainability practitioners working in the financial sector who want to quickly identify resources to support deforestation-free finance.

Forest Pathways Report 2023

A global goal was set at the 2021 UN Climate Change Conference (COP26) to halt and reverse deforestation by 2030. This comprehensive report from WWF can help you understand why we are off track from that goal and how we can get back on track. It provides an analysis of deforestation and restoration trends and proposes a blueprint of essential measures to save forests by 2030. Beyond sustainability, this resource contains important insights relevant to supply chain management, public and community relations, and strategy.

Forest 500: A decade of deforestation data

This annual report from Global Canopy can help you understand the lack of progress on market-driven deforestation and what companies and financial institutions can do to get back on track. The report highlights leaders and laggards on deforestation over the past decade and highlights ten lessons that can help companies to take meaningful action. These lessons include recognising the inefficacy of voluntary action, the need for transparent reporting, and the importance of recognising deforestation as being central to the climate action agenda. These insights will be most useful to sustainability and supply chain teams whose value chains are linked to forest products.

The State of the World’s Forests 2022

This report from the UN Food and Agriculture Organisation will show you how we can work with forests to help address the climate and biodiversity crises. It outlines three interrelated pathways. They are stopping deforestation and maintaining existing forests; restoring degraded lands and expanding agroforestry; and rethinking how we can use forests resources sustainably. The report demonstrates the feasibility and benefit of these pathways and outlines some of the steps both private and public sector can take toward them. These insights will be most useful to procurement and supply chain managers whose value chains rely on the ecosystem goods and services of forests.

The Forest Transition: From Risk to Resilience

Forests are gaining increasing attention for their central role in the resilience of our global economy. This report from CDP can help you understand the importance of addressing deforestation for your business. It explores deforestation risks, current progress on eliminating deforestation, and the essential actions companies need to take to remove deforestation from within their supply chains. It will be most useful to sustainability and supply chain management teams, especially those working in industries with ‘hidden dependencies’ on forests, such as chemicals, retail, and consumer goods.

Deforestation Monitoring and Response Framework

The Forest Positive Coalition has created a framework to proactively monitor and address deforestation and peat non-compliances. The framework is a living document, and it aims to create a more efficient and effective approach for dealing with non-compliance with 'No Deforestation or Peat Development' commitments. It has two sections: guidance on minimum requirements for monitoring, and a response framework that clarifies roles and responsibilities across the supply chain.

Although the scope of the monitoring is for palm oil only, the learning outcomes will be shared for other commodities across the Forest Positive Coalition members.

Deforestation Scorecard: Assessing Corporate Action on Deforestation Amid Growing Regulatory Risk

Ending deforestation is necessary to meet net zero targets, and yet commodity production continues to drive forest loss. In response, regulations are rapidly evolving, creating transition risks for businesses worldwide. This report from Ceres can help you mitigate this risk. It demonstrates what a robust no-deforestation policy looks like, and features a Deforestation Scorecard that examines no-deforestation policies on four measures: cross-commodity coverage, geographic coverage, the presence of a time-bound commitment, and the target deforestation cutoff date. It also uses this scorecard to assess the deforestation policies of 53 large companies. This resource will be most useful to supply chain management, legal, and enterprise risk teams.

Forests Under Fire: Tracking progress on 2030 forest goals

This resource from the Forest Declaration Assessment can help you to better understand the status of international efforts to halt and reverse forest loss and degradation by 2030. The report indicates whether the world, regions, and individual countries are “on track” or “off track” towards 2030 forest goals using the most up-to-date annual data, and it reveals that global goals to protect, conserve, and restore forests are becoming increasingly distant from reality. The report explains the state of global progress towards eliminating deforestation and forest degradation by 2030; the state of tree cover loss due to fires; the state of efforts to protect and conserve biodiversity in forests; and more. It also provides high-level recommendations to help bridge the gaps in progress.

Why Preserving Forest Integrity Is As Vital As Preventing Deforestation

This quick read from the World Resources Institute can help you to understand the importance of forest integrity, which refers to the health of standing forests, including their ability to store carbon and protect biodiversity. This article explains the concept of forest integrity; identifies the greatest threats to forest integrity; explains where forest integrity is most at risk; and identifies actions required to protect high-integrity forests and restore other forests.

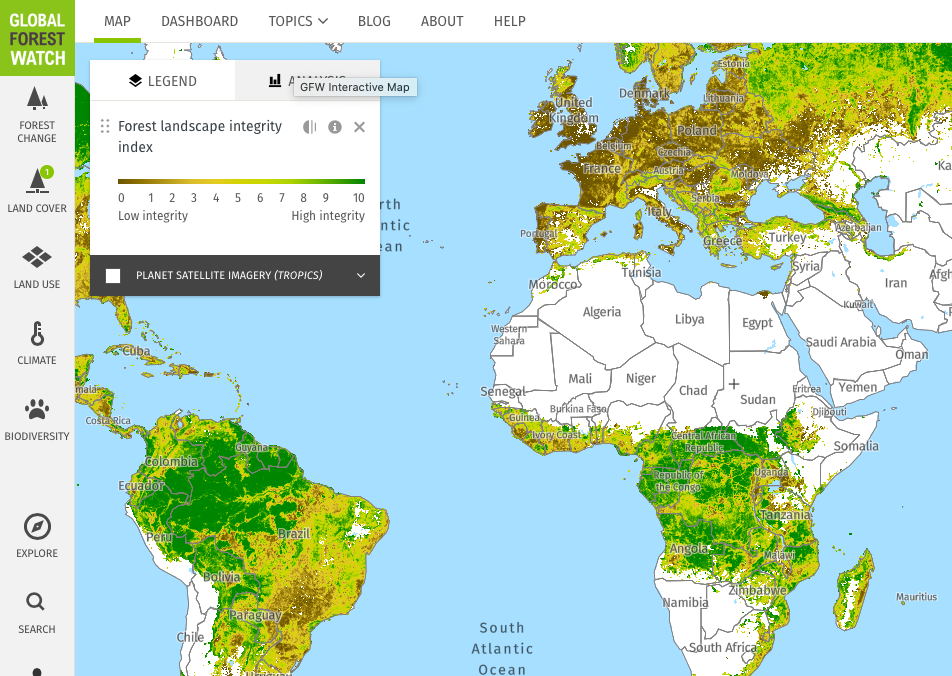

Global Forest Watch

This online platform provides data and tools for monitoring forests, and will help you to access near real-time information about where and how forests are changing around the world. The maps features allow you to visualise and analyse historical trends in tree cover loss and gain since 2000, view land cover, and toggle for various country-specific climate and biodiversity factors. This tool may be particularly helpful to sustainability, oversight, and procurement professionals who are responsible for monitoring illegal deforestation, defending land and resources, and ensuring commodities are sustainably sourced.

Investor Guide to Deforestation and Climate Change

This introductory guide from Ceres can help you to understand and act on deforestation-driven climate risks across your portfolios. It features a framework to help investors understand and engage on deforestation-driven climate risks across portfolios. It also outlines key expectations that investors should be looking for in corporate climate and deforestation commitments, and provides example questions for company and sector engagements.

Finance Sector Deforestation Action (FSDA): Expectations for Commercial and Investment Banks

This paper from the FSDA and the Institutional Investors Group on Climate Change (IIGCC) was created to set out investor expectations for banks on eliminating commodity-driven deforestation, conversion, and associated human rights abuses in their lending and investment practices. It explains investor implementation expectations for commercial and investment banks in relation to risk assessment, commitment and governance, expectations of clients, monitoring and compliance, and disclosure.

Although specifically created for banks, this paper's lessons are also applicable to other financial institutions and investors.

From Commitments to Action at Scale: Critical steps to achieve deforestation-free supply chains

The CDP is a not-for-profit charity that runs the global disclosure system for investors, companies, cities, states, and regions to manage their environmental impacts. In addition to their work on carbon and climate change, they have created a range of resources to help your company take action on deforestation. Their Global Forests Report is a good resource for helping change agents understand the scale, scope, and rigour of actions required to tackle deforestation so that they can better summarise and translate these findings for executives and boards. Building off previous CDP and Accountability Framework Initiative (AFi) analysis, this report highlights areas of progress and gaps in performance and provides insights that can help your company learn from the progress of industry peers. Each section of the report summarizes key elements of the Accountability Framework’s Core Principles and guidance followed by corresponding analysis of company performance using CDP data.

Time For Transparency: Deforestation- and conversion-free supply chains

This report from CDP can help you understand the current level of corporate disclosure on deforestation- and conversion-free (DCF) supply chains. It shows that while achievement and disclosure of DCF supply chains is possible, it remains uncommon. Of the 881 companies that reported on deforestation to CDP in 2023, only 21% made sufficient disclosures and only 7% demonstrated at least one DCF commodity supply chain. The report explains progress on different commodities and the common issues with disclosure quality; highlights the success factors of those companies leading on DCF; and provides six recommendations for improved reporting. These insights will be useful to supply chain and sustainability practitioners in organisations with commodity supply chains.

CTrees

This interactive map from CTrees can help you understand the scale of tropical forest degradation around the world. It uses artificial intelligence and advanced satellite data to track tree cover loss and forest degradation since 2017 down to 5 square meter areas. Tree cover loss refers to the complete clearing of forests, while forest degradation refers to a loss of trees, carbon, and other ecosystem services. Both are driven by logging, fire, and road construction. The map’s filters allow you to visualise tree cover loss or forest degradation by type. It also provides country-level data on the total hectares of stable forest, tree cover loss, and forest degradation. This map will be most useful to supply chain management and risk teams whose value chains are connected to tropical forests.

Deforestation Disclosure Guide for Financial Institutions: Towards integrated nature and climate-related financial disclosure

This guide from WBCSD can help you understand how deforestation creates risk for financial institutions and how to meet growing expectations for disclosure on deforestation. Written for those working on sustainability at banks, insurers, and asset management firms, the guide begins by providing a background on the interconnection between nature and climate risks; deforestation risk in portfolio companies; and sustainability-related disclosure frameworks. Next, it explores two deforestation-specific disclosure frameworks: the CDP Financial Services questionnaire and the Deforestation-free Finance Roadmap. It then examines how deforestation-risk can be integrated into IFRS S2, TNFD, and select US and European disclosure regulations. It concludes by outlining key challenges and four steps that financial institutions can take immediately to assess and reduce deforestation risks in their portfolios.

Forest Declaration Dashboard

This data dashboard was created by the Forest Declaration Assessment and Systems Change Lab. It tracks the progress of countries on their commitments to end deforestation by 2030, which were made at COP26 in 2021 under the Glasgow Leaders’ Declaration on Forests and Land Use. The dashboard showcases progress on the six articles outlined in the declaration, including ecosystems, trade, livelihoods, agriculture, increasing finance, and aligning finance. For each article, the dashboard provides a summary of collective progress revealing that, in all cases, it is insufficient. The tool also allows users to explore progress on the indicators at a country level. This tool may be particularly useful to procurement and supply chain professionals assessing sourcing regions or sustainability professionals monitoring policy and financing developments around deforestation.

Understanding Finance and Nature Markets

Biodiversity Loss and Land Degradation: An Overview of the Financial Materiality

This brief from CISL explains biodiversity loss and land degradation, why they matter, the financial implications of such decline, and methods for quantification. This brief may be a helpful primer for executives and board members who want to better understand how to prioritise these issues and to determine the cost of inaction.

A Buyer's Guide to Natural Climate Solutions Carbon Credits

This guide produced by the Natural Climate Solutions Alliance, WBCSD, and BCG is designed to help companies select and procure high-quality carbon credits on the voluntary carbon market. It focuses specifically on natural climate solution (NCS) credits, which are intended to support carbon reduction while also providing co-benefits for communities and biodiversity. Going step-by-step, the guide outlines how to integrate NCS carbon credits into your climate strategy. This includes setting procurement criteria, finding sources, purchasing, and reporting credible claims. The guidance will be most useful to sustainability and procurement teams.

Biodiversity Finance Reference Guide

The IFC has developed this guide to help you to better understand project eligibility criteria for biodiversity finance, as well as some of the more common project types. The guide builds on the Green Bond Principles and the Green Loan Principles and highlights different types of investment projects, activities, and components that help protect, maintain, or enhance biodiversity and ecosystem services, as well as promote the sustainable management of natural resources. This is a good resource for identifying opportunities to address the key drivers of biodiversity loss in your production practices; to integrate nature-based solutions into their operations; and to develop nature conservation activities.

The PBAF Standard

Developed to address gaps within the financial sector, this standard by the Partnership for Biodiversity Accounting Financials (PBAF) can help you to understand the biodiversity-related information lenders and investors may expect you to disclose. It includes two assessments: the first provides guidance on assessing the biodiversity impacts of loans and investments, and the second outlines how to assess a financial institution’s dependencies on ecosystem services. The standard will be most useful to sustainability, communication, and finance professionals.

Making Nature Markets Work

This landmark report by the Taskforce on Nature Markets can help you understand how nature-conserving behaviour can be incentivised through global markets. The report covers the rise of nature markets, their dangers, and their potential. It also makes 7 major recommendations to harness their power to support the transition to a post-carbon economy. The economic shift this report urgently calls for makes it particularly relevant to decision-makers, especially heads of finance and supply chains.

Deforestation-free finance: a guide on tools and frameworks for financial institutions

This report from WBCSD can help you understand how banks and investors can avoid financing deforestation. The report provides an overview of three key frameworks for assessing and disclosing deforestation risk exposure in your investment and lending portfolios, and reviews the assessment and data collection tools you can use to support this work. It also highlights tools for aligning with important global frameworks for nature, such as the Taskforce for Nature-Related Financial Disclosure (TNFD) and the Global Biodiversity Framework. This report will be most useful to sustainability practitioners working in the financial sector who want to quickly identify resources to support deforestation-free finance.

Biodiversity Offsets: A User Guide

The mitigation hierarchy holds that avoiding, minimizing, rectifying, and reducing impacts to the natural environment are all preferable to offsetting, but there are situations where biodiversity offsets are a necessity. This guide from the Convention on Biological Diversity will help you understand when to consider using offsets, and explains the core principles and limits of offsetting.

A Practical Guide to Insetting

Insetting refers to a company offsetting its emissions through projects that avoid, reduce, or sequester carbon within its own value chain. It is an opportunity for businesses to link emissions and carbon sequestration to their sourcing landscapes. This guide from the International Platform for Insetting shares insights and provides recommendations that will help you to transform your supply chain for a resilient, regenerative, net zero carbon future that values and protects nature. The guide was created specifically for insetting practitioners and stakeholders that want to learn more about the concept, and it highlights lessons and opportunities for realising the full potential of insetting.

Exploring Design Principles for High Integrity and Scalable Voluntary Biodiversity Credits

This working paper from The Biodiversity Consultancy can help you understand what makes a high integrity biodiversity credit. The paper outlines the potential for voluntary biodiversity credits to support a nature-positive future, explains how integrity is defined, and explains the risks to credit integrity. It also proposes twelve principles for credible biodiversity credits and a flexible measurement framework. This is a valuable resource for those making decisions related to investing in biodiversity through credit purchase, or the development of biodiversity insetting projects across the value chain.

Biodiversity Credit Markets: The role of law, regulation and policy

This paper from Pollination and the Taskforce on Nature Markets can help you understand what policies are needed for voluntary biodiversity credits markets to reach their potential. The paper explores the role of law, regulations, and policy; the different market types; lessons learned from biodiversity offset schemes; emerging biodiversity credit markets; and policy tools for scaling biodiversity credit markets. The implications of the recommended policy changes will be most relevant to sustainability and enterprise risk teams.

The Rights of Nature: Developments and implications for the governance of nature markets

This paper from the Taskforce on Nature Markets can help you understand the emerging perspective that nature has fundamental rights and human beings have the legal authority and responsibility to enforce these rights on nature's behalf. It traces how this trend is being expressed in environmental law and the implications for nature-linked markets, including within nature credits and soft commodity markets. This paper points to a paradigm shift that will be most relevant to sustainability and legal practitioners.

Harnessing Biodiversity Credits for People and Planet

This paper from NatureFinance, Carbone 4, and the Global Environment Facility (GEF) can help you understand the biodiversity credit markets' key challenges and solutions. The first section covers how five key challenges can be addressed to ensure high-integrity supply, scaled demand, and equitable distribution of benefits. The second section offers a roadmap to scale up these solutions and financial flows into biodiversity markets. The guidance will be most useful to sustainability and finance departments interested in recent trends and perspectives on biodiversity credits.

Biodiversity Credit Alliance

The Biodiversity Credit Alliance (BCA) was created to bring clarity to the development of a credible and scalable voluntary biodiversity credit market. This paper from the BCA can help you understand the essential role of Indigenous Peoples and Local Communities (IPLCs) in biodiversity projects and the biodiversity credit market. It provides an overview of the emerging biodiversity credit market; explains the rights of Indigenous Peoples and how credit markets benefit from involving IPLCs; and puts forth an initial list of ideas for how credit buyers and policymakers can ensure IPLCs' rights and benefits are respected. This guide will be most useful to sustainability practitioners seeking to purchase high-quality biodiversity credits.

Nature Market Principles

This set of principles developed by Finance Earth and others can help you develop and invest in credible nature-based solution (NbS) projects. It outlines seven voluntary principles for developers of NbS projects: 1) science-based nature recovery; 2) environmental & social safeguarding; 3) additionality; 4) permanence & financial prudence; 5) seek co-benefits; 6) verifiability; and 7) transparency. For investors, it outlines two principles: 1) buyer screening criteria, and 2) commitment to best practices. The clear set of principles provided will be especially useful to sustainability and finance teams.

Although these principles were made with UK-based companies in mind, the lessons are relevant beyond that geographic context.

Accounting for Natural Climate Solutions Guidance

Natural climate solutions have been recognised as key levers in mitigating the negative impacts of climate change, with ~12% of global impacts from GHG emissions coming from land use and land-use changes (LULUC). To support you in calculating, accounting for, and reporting on LULUC-generated GHG emissions, the Accounting for Natural Climate Solutions Guidance from Quantis delivers a robust methodology to embed land-related emissions in corporate and product footprints, which can be used for setting science-based climate targets. Additionally, the supporting Annex document provides detailed information on the scope of the proposed methodology, including technical instructions, context, debated challenges, and limitations, as well as references.

Aligning Accounting Approaches for Nature

This project by the Capitals Coalition can help you standardise natural capital accounting practices. The project has produced a series of guides with the aim of developing a generally accepted suite of methods, indicators, and criteria for biodiversity measurement and valuation tools and approaches for businesses and financial institutions. These resources include a business primer on assessing the overall quality of an ecosystem; guidance for measuring and valuing biodiversity at the site level and across supply chains; and recommendations for a standard on corporate biodiversity measurement and valuation. These guides will be most useful to sustainability practitioners and finance teams interested in natural and multi-capital accounting.

Decent Work in Nature-based Solutions

This new biennial report from UNEP, ILO, and IUCN anticipates that the scaling up of funding for nature-based solutions (NbS) will create significant new employment globally. It aims to initiate systemic engagement around understanding the socioeconomic impacts of NbS-related work. The report provides context on the estimated scale of job creation and how Just Transition strategies can be integrated to ensure decent work. Sustainability and supply chain management teams may find it particularly useful as expectations grow for the private sector to play a much greater role in funding NbS through supply chains and investments.

Biodiversity Credits: A Guide to Support Early Use with High Integrity

This white paper from the World Economic Forum can help you to better understand the different use cases for biodiversity credits. The first section outlines five use cases, such as enhancing carbon credits or supporting ecosystem services that your business relies on. The second section covers how credit purchasers can mitigate the risks associated with using biodiversity credits. The third and final section explains how to ensure high-integrity credits are used in each of the five use cases. This guidance will be most useful to sustainability and finance professionals involved in purchasing credits.

Other Resources

Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy

This report, the first in the World Economic Forum's 'New Nature Economy' report series, will help you to better understand the dependency and impact of business on nature. The report uses a simple three-stage breakdown: 1) acknowledging and explaining the crisis of biodiversity decline, 2) identifying material risks, and 3) managing material risks. This report explores the scale and urgency of the biodiversity decline emergency and the drivers of nature loss, and provides a helpful fit-for-purpose framework for managing nature-based risks.

Global Biodiversity Score: Accounting for positive and negative impacts throughout the value chain

This tool can help you to evaluate the impact of your activities and investments on biodiversity. It establishes a biodiversity footprint measure expressed in an aggregated metric that represents ecosystem integrity, and uses the concept of Scope (similar to climate emission assessments) to break down impacts from across the value chain. This reference tool will be especially beneficial to sustainability professionals that want to improve the credibility of their nature-related commitments enhance their company's efforts to protect and restore biodiversity.

Biodiversity Loss and Land Degradation: An Overview of the Financial Materiality

This brief from CISL explains biodiversity loss and land degradation, why they matter, the financial implications of such decline, and methods for quantification. This brief may be a helpful primer for executives and board members who want to better understand how to prioritise these issues and to determine the cost of inaction.

The IPBES Assessment Report on the Sustainable Use of Wild Species

Billions of people benefit daily from the use of wild species for food, energy, materials, medicine, recreation, inspiration, and more. 50,000 wild species meet the needs of billions of people worldwide, and more than 10,000 wild species are directly harvested for food. This report by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) can help you to understand how the global biodiversity crisis threatens the contributions of these species to humanity, and provides insights, analysis, and tools to establish more sustainable use of wild species of plants, animals, fungi and algae around the world.

This report identifies five broad categories of ‘practices’ in the use of wild species: fishing; gathering; logging; terrestrial animal harvesting (including hunting); and non-extractive practices, such as observing. For each practice, it then examines specific ‘uses’ for these materials; identifies trends and drivers of change; explores policies, practices, and tools to effect positive change; and examines a range of possible future scenarios for the use of wild species.

Upscaling Corporate Solutions for Biodiversity

This report from Entreprises pour l’Environnement can help you to better understand tangible actions that your business can take to support biodiversity. It explains how businesses can avoid or reduce pressure on biodiversity, including through land use, pollution, and invasive species management; describes the different ways that businesses can enable and support biodiverse areas through conservation, rewilding, and renaturing artificialised areas; and explains how to factor nature into business decisions. Each chapter includes a series of brief case studies demonstrating biodiversity action implementation. The insights provided are wide-ranging and will be useful to any business function involved in biodiversity-related projects.

GRI 101: Biodiversity 2024

GRI’s revised biodiversity reporting standard can help you understand and disclose your most significant biodiversity impacts. It covers supply chain impacts, location-specific reporting, disclosures on direct drivers of biodiversity loss, as well as social impacts related to biodiversity loss. This resource will be most useful to sustainability professionals.

Biodiversity Risk: Legal Implications for Companies and their Directors

Businesses face real and potentially significant material risk from biodiversity loss. This report from the Commonwealth Climate and Law Institute (CCLI) can help directors, investors, accountants, procurement professionals, and legal professionals to assess biodiversity dependencies and impacts and to better embed these factors into strategy and disclosure processes. The report explains how directors may face the risk of liability for a failure to consider biodiversity risks in governance and disclosure, and provides a jurisdictional spotlight on duties of care. The guide also provides key questions board directors should ask to ensure they are meeting their duties to the company.

Integrating Nature: The case for action on nature-related financial risks

This paper from the University of Cambridge Institute for Sustainability Leadership (CISL) can help you better understand the case for integrating nature-related risks into financial decisions. It explains why integration is needed, how it can be done, and outlines four use cases for assessing specific nature-related financial risks. These cases demonstrate the opportunities to mitigate financial risks. The paper also highlights six ways to accelerate the integration of nature into financial decision-making. This resource will be most useful to senior management and sustainability practitioners seeking to engage senior managers.

The State of the World's Biodiversity for Food and Agriculture

This comprehensive guide from the Food and Agriculture Organization of the United Nations presents the first global assessment of biodiversity for food and agriculture worldwide. The report draws on information from 91 country reports to provide a description of the roles and importance of biodiversity for food and agriculture, the drivers of change affecting it, and its current status and trends. It describes the state of efforts to promote the sustainable use and conservation of biodiversity for food and agriculture, including through the development of supporting policies, legal frameworks, institutions and capacities. It also explains the needs and challenges of future management of biodiversity for food and agriculture. This resource is an excellent starting point for change agents to build their awareness and understanding of the vital importance of biodiversity to global food systems.

Bending the Curve of Global Freshwater Biodiversity Loss: An Emergency Recovery Plan

This paper outlines six priority steps for restoring biodiversity in rivers, lakes, and wetlands. These steps address improving environmental flows; improving water quality; protecting and restoring critical habitats; improving fisheries management; managing invasive species; and restoring waterway connectivity. The practical steps and examples described may be useful to a range of departments that can play a role in restoring ecosystems, including strategic planning, procurement, and sustainability.

Best Practices in Gender and Biodiversity: Pathways for multiple benefits

This report produced by the Convention on Biological Diversity can help you understand how biodiversity conservation efforts are enhanced when gender issues are addressed. Based on a review of best practices from diverse projects around the world, it provides a review of best practices, summaries of action areas, and implementation mechanisms. The report also features a collection of case studies and best practice snapshots. These insights will be most useful to sustainability and procurement practitioners.