Fair Tax and Benefit Sharing

Description

Includes tax payment in appropriate (not tax-preferential) jurisdictions; appropriate amounts, timing, and jurisdictions; avoiding base erosion and profit shifting (BEPS); and fair distribution of resources, benefits, and opportunities.

Share this Subissue on:LinkedIn

Resources

Fair Taxation

Fair Tax Mark

The Fair Tax Foundation was launched in 2014, and was developed by a team of tax justice, corporate responsibility, and ethical consumerism experts. The product of their efforts was the Fair Tax Mark: an accreditation scheme created to encourage and recognise businesses that pay the right amount of corporation tax at the right time and in the right place. Their assessment process involves the review of policy, reporting, and tax payments, and includes suggestions for improvement. If your company is motivated and committed to advancing tax justice and transparency, an excellent first step is to review the Fair Tax Mark's standards, guidance notes, and FAQs and to pursue accreditation.

Tax Justice Network

The Tax Justice Network (TJN) is an advocacy group that creates and curates resources to help address tax avoidance, tax competition, and tax havens. Their learning hub includes short, introductory guides on key tax justice issues, curated collections of relevant articles, and pioneering research reports, such as the State of Tax Justice report. They have also developed a broad range of tools and indexes, such as country profiles on tax havens; the Financial Secrecy Index; the Corporate Tax Haven Index; and the Illicit Financial Flows Vulnerability Tracker. The TJN is a key reference point for leaders and senior sustainability professionals who want to advance the ethics of corporate tax strategy and tax disclosures, both within their organisation and across their industry.

A New Bar for Responsible Tax: The B Team Responsible Tax Principles

This short guide from the B Team provides an approach to taxation that can help your company to demonstrate tax responsibility and play its part in creating a more stable and sustainable society. It lays out seven principles for responsible taxation that your company can implement and endorse to support stable, secure, and sustainable societies; issues calls to action for business, governments, and civil society; and highlights the debates, discussions, and experiences of the companies that helped to shape the Principles. This guide is a good starting point for learning and developing good tax practices, and would be most beneficial to sustainability, legal, and compliance professionals.

Financial Secrecy Index

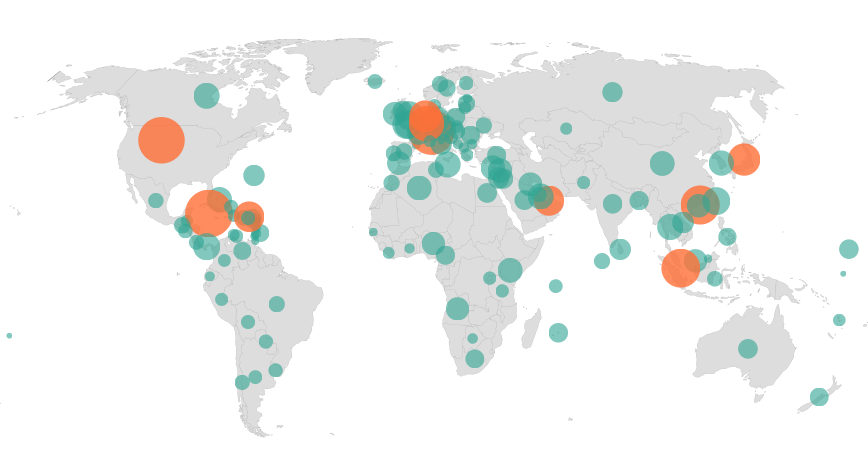

Launched in 2020, the Financial Secrecy Index is a tool for understanding global financial secrecy, tax havens or secrecy jurisdictions, and illicit financial flows. The tool features an interactive overview map and interactive nation-centered databases that ranks jurisdictions according to transparent qualitative and quantitative criteria. This tool will help you to understand that most of the world’s most important providers of financial secrecy are, in fact, among the world’s biggest and wealthiest countries, and will empower you to directly confront offshore secrecy and the global infrastructure that creates and perpetuates it.

Corporate Tax Haven Index

This index clearly identifies and ranks the jurisdictions most complicit in helping corporations to avoid paying their fair share of taxes. It also highlights laws and policies that your business can support towards reducing the ability of these jurisdictions to perpetuate such abuse.

Leeds Building Society - "We've been accredited with the Fair Tax Mark again"

The Leeds Building Society provides an excellent example of tax transparency that can help you to benchmark your tax payment-related performance and to craft a credible position statement on fair tax payments. These examples provide a consice and coherent explanation for why the Leeds Building Society believes it is important to pay the right amount of tax, at the right time, in compliance with the spirit and letter of the law, and they explain why the Leeds Building Society was personally motivated to pursue Fair Tax Mark accreditation. These resources also explain how they manage and monitor tax risk, and how they plan to engage with relevant tax authorities to ensure compliance.

Partnerships and Sharing

The Partnering Initiative

The Partnering Initiative (TPI) has created a range of resources to support multi-stakeholder collaboration among business, governments, NGOs, and the United Nations. Their tools, guidebooks, case studies, and other resources cover a broad range of aspects of partnering, including maximising partnership value creation, partnering for philanthropic impact, collaboration for the SDGs, exit aspects of partnerships, and practical approaches to brokering and communicating. TPI is a good starting point for leaders and practitioners who want to develop their engagement skills and create systems and mechanisms for convening sktaeholders and catalysing partnerships.

Unlocking the Power of Partnerships

This report aims to highlight the potential strength of effective cross-sector partnerships in delivering against broader societal sustainability goals. KPMG have supplemented their own experiences with one-to-one interviews and research to put forward a framework of eight factors that should be considered when creating, operating, and sustaining collaborative partnerships.

Strategic Philanthropy for a Complex World

When it comes to community investment, practitioners often take a predictive approach, where we expect A to lead to B and then C. However, this doesn't tend to align with the multi-faceted nature of sustainability issues. This article from the Stanford Social Innovation Review can help you to become familiar with the idea of developing a emergent approach to community investment. It is targeted at philanthropic foundations, but should be valuable for a diverse range of sustainability practitioners.

Freeport-McMoRan: Localising Global Social Investment Strategies

This brief case from Business for Social Responsibility (BSR) demonstrates how mutual benefits can be derived by businesses collaborating with NGOs and communities to explore opportunities for investment. It explores how a non-profit organisation worked with a major mining company to develop a new approach to engaging communities, and helped shift the company's emphasis on investments in philanthropy towards a participatory approach to investments that satisfied both the company's and community's needs.

Seven Principles for Partnerships with Frontline Communities

This set of principles from B Lab can help you understand how to build mutually beneficial and equitable partnerships with local communities. It is based on seven principles that came out of a co-creation process involving B Corp employees and community leaders. These principles include centering trust and transparent communications; centering local wisdom and perspectives; committing to equitable resource allocation; prioritising racial and cultural literacy; centering conflict acknowledgement and trust regeneration; co-developing clear and equitable decision-making processes; and centering long-term and sustainability commitments to best ensure collective survival. These principles will be most useful to community relations practitioners and anyone else involved in work that impacts communities, such as supply chain management, sustainability, and project management teams.

Sustainability Through Partnerships

This report offers a comprehensive summary of how collaboration is key to unlocking sustainability. The report starts with the premise that no single organisation or sector has the knowledge or resources to "go it alone," and explores the nature and characteristics of different types of multi-sector partnerships before offering a model for the creation of cross-sector partnerships. The report ends with a series of focused recommendations and good practice for different groups (Business, NGOs, Government, and Communities) engaging in partnerships.