Disclose

Description

These resources will help you to identify and transparently disclose performance data, processes, assumptions, successes, challenges, failures, and other information that helps others understand your sustainability performance and to put that into context.

Share this Practice on:LinkedIn

Resources

Primers for Senior Leaders

A Starter’s Guide to Sustainability Reporting

Produced by Chartered Professional Accountants Canada, this is an introductory roadmap for companies new to sustainability reporting. The guide covers current practices, offers insight into relevant reporting frameworks, and uses examples to outline the steps involved in developing a reporting process.

Sustainability Reporting Frameworks: A Guide for CIOs

This report is an excellent primer on most commonly cited ESG reporting frameworks: the Climate Disclosure Project (CDP), the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). Although intended for CIOs, this report will provide executives and change agents across the spectrum with a basic understanding of the frameworks and their fundamental differences, including audience, scope, and competing definitions.

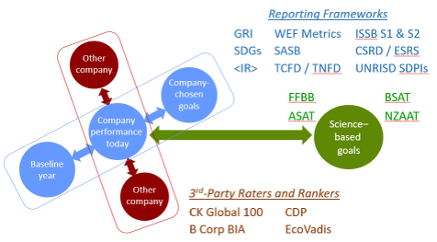

Comparison of Sustainability Assessment Frameworks

Some sustainability frameworks (e.g., GRI, SDGs, SASB, TCFD, B Corp BIA, CSRD, ISO 26000) are used by organisations to plan, assess, and report on their progress towards sustainability-related goals that they have set for themselves. Other frameworks (e.g., Global 100, DJSI, 100 Best Corporate Citizens, CDP) are used by 3rd parties to rate and rank companies on their sustainability performance. This free, open-source spreadsheet and table from Sustainability Advantage compares how key sustainability reporting, assessment, and ranking frameworks used by large companies assess and address 18 core environmental, workplace, community, and governance sustainability topics. This one-stop shop will be particularly helpful for bringing employees, leaders, and budding change agents up to speed on corporate sustainability frameworks.

This free, open-source spreadsheet / table from Sustainability Advantage compares how the dozen sustainability reporting, assessment and ranking frameworks used by large companies assess the 18 core environmental, employee, community and governance sustainability topics / issues. Comparison of Sustainability Assessment Frameworks

Disclosure Principles, Standards, and Guidance

About Sustainability Reporting: The GRI Standards

Developed in 1997, the GRI Sustainability Reporting Standards (GRI Standards) became the first and most widely used global standards for sustainability reporting. Today, over 12,000 companies use GRI Guidelines for sustainability reports, and they continue to serve as a credible global industry standard. This link introduces the global best practices for reporting publicly on universal standards. It also dives into a range of more specific topics related to social, environmental, and economic impacts.

The Taskforce on Nature-related Financial Disclosures

Reversing global nature loss depends on a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes. This depends on large and small businesses across supply chains, financial institutions, and industries of all types collectively identifying, assessing, managing, and disclosing nature-related dependencies, impacts, risks, and opportunities. Towards meeting this inter-industrial challenge, the Taskforce on Nature-related Financial Disclosures (TNFD) was established in 2021 in response to the growing need to factor nature into financial and business decisions.

The TNFD has developed a market-led, science-based risk management and disclosure framework for organisations to report and act on evolving nature-related risks and opportunities. The TNFD has also developed case studies and sector-specific guidance; a Knowledge Hub that features a curated collection of the latest external resources and market insights on nature-related risks and opportunities; and an open-access Learning Lab that supports self-paced learning about nature-related issues, the TNFD recommendations, and additional guidance.

Interoperability mapping between the GRI standards and the TNFD Disclosure Recommendations and metrics

This interoperability mapping resource can help you to make better sense of GRI and TNFD disclosure requirements and support your reporting efforts. It provides a detailed overview of alignment between the TNFD Disclosure Recommendations and metrics and the GRI Standards, including GRI 101: Biodiversity 2024 and relevant disclosures from the GRI Universal and Topic Standards.

The Task Force on Climate-related Financial Disclosures

Momentum is growing for organisations to formally and transparently articulate the risks that climate change poses to the value of their assets and their future profitability. The Task Force on Climate-related Financial Disclosures (TCFD) emerged as a response to this call for action, empowering companies to more effectively measure and evaluate their own risks and those of their suppliers and competitors. The TCFD promoted “consistent, comparable, reliable, clear, and efficient” voluntary climate-related financial disclosures, and has developed comprehensive recommendations and resources in support of this. These resources focus on governance, strategy, risk, metrics, targets, and the use of scenario analysis for evaluating climate-related financial risks and opportunities.

The TCFD has produced a comprehensive Final Recommendations report and several supplemental reports, including a Technical supplement, which provides in-depth information and tools for using scenario analyses to understand the strategic implications of climate-related risks and opportunities to your organisation.

Although these resources remain to be an invaluable source of guidance, the Financial Stability Board (FSB) and IFRS have announced that the TCFD has fulfilled its remit and disbanded, and that monitoring of the progress of corporate climate-related disclosures now rests with the IFRS Foundation's ISSB.

TCFD Good Practice Handbook

This handbook from the Climate Disclosure Standards Board (CDSB) and the Sustainability Accounting Standards Board (SASB) identifies good practices in implementing the TCFD recommendations. Drawing upon a diverse range of examples, these good practices cover the four core elements of governance, strategy, risk management, and metrics and targets.

The CSRD: A guide for companies

The CSRD is intended to bring sustainability reporting up to the same quality and control bar as financial reporting, and companies will need to elevate the breadth and robustness of their ESG reporting to comply with these new regulations. Watershed has created this short guide to help you to better understand the CSRD’s technical rules, also known as the European Sustainability Reporting Standards. These rules include topics such as general disclosures, social and environmental standards, and governance standards. It also unpacks how the CSRD define "double materiality" and outlines timeframes and other CSRD reporting expectations.

EU Corporate Sustainability Reporting Directive — What Do Companies Need to Know

This brief article from Harvard Law school explains what the EU’s new Corporate Sustainability Reporting Directive (CSRD) disclosure requirements mean for business outside of the EU. It outlines what businesses it applies to, the timeline over which it will be phased in, provides a summary of key aspects of the disclosure standard, and identifies where if differs from existing standards. These insights will be most useful to sustainability and legal teams.

Implementation Guidance for the International Sustainability Standards Board (ISSB) Standards and the European Sustainability Reporting Standards (ESRS)

This guidance from the WBCSD CFO Network can help you to better meet modern sustainability reporting requirements and respond more credibly to requests for sustainability performance information from investors, banks and regulators. It provides a side-by-side analysis of two new sustainability disclosure standards: the IFRS standard from the International Sustainability Standards Board (ISSB) and the European Sustainability Reporting Standard. It explains how to set up reporting; identifies what needs to be reported; explains how to ensure credible disclosures; and more. This guidance may be especially useful to CFOs and finance teams.

ESRS–ISSB Standards: Interoperability Guidance

This guide was created by the European Commission, the European Financial Reporting Advisory Group (EFRAG), and the International Financial Reporting Standards Foundation (IFRS) to help you better understand how to comply with both the European Sustainability Reporting Standards (ESRS) and the IFRS Sustainability Disclosure Standards (ISSB Standards). It examines and explains the general alignment and interoperability between these reporting requirements, and outlines the high level of interoperability on climate-related disclosures. It also clarifies differences that must be addressed to ensure compliance between them. This guidance will be most useful to sustainability and compliance teams whose organisations must report under both sets of standards.

Ten things to know about the first ISSB Standards

This article from the IFRS can help you understand what the new ISSB standards are about. The inaugural IFRS Sustainability Disclosure Standards were issued to provide a global baseline of sustainability-related disclosures for the capital markets. IFRS S1 requires companies to communicate the sustainability-related risks and opportunities they face over the short, medium, and long term, and IFRS S2 sets out specific climate-related disclosures and is designed to be used with IFRS S1. This article provides a useful overview for Sustainability and Finance teams that will be making use of the new standards in their corporate reporting.

IFRS Sustainability Disclosure Standards

The IFRS Foundation is a not-for-profit responsible for developing global accounting and sustainability disclosure standards, known as the IFRS Standards. The International Sustainability Standards Board (ISSB) is an independent standard-setting body within the IFRS Foundation, and they have created a framework for the global business community to disclose material information on sustainability and exposure to climate-related risks and opportunities. This will help ensure that companies are providing consistent and comparable sustainability-related information alongside financial statements, in the same reporting package.

IFRS S1 provides a set of general reporting requirements for disclosing sustainability-related risks over the short, medium, and long term. IFRS S2 sets out specific climate-related disclosures, including the impact that climate change will have on an entity’s financial position, performance, cash flows, strategy, and business model. IFRS S2 is designed to be used with IFRS S1, and both of these standards fully incorporate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

UN Guiding Principles Reporting Framework

This reporting framework - and the associated guidance documents from Shift and Mazars - puts corporate reporting on human rights into straightforward language. The framework features a short series of questions to evaluate maturity and progress; implementation guidance; and assurance guidance, which is intended to support internal auditors in assuring companies' human rights performance and external auditors in assuring human rights reporting. These resources will be most useful to sustainability, compliance, and legal teams.

IWA 48:2024: Framework for implementing environmental, social and governance (ESG) principles

This set of ESG implementation principles from ISO can help you to better navigate the complex landscape of environmental, social, and governance expectations and to implement and embed ESG practices within your organisation. Developed through a collaborative cohort that includes the British Standards Institution (BSI), the Standards Council of Canada (SCC), and the Brazilian Association of Technical Standards (ABNT), the principles incorporate input from over 1,900 industry experts across 128 countries. They provide a high-level structure for integrating existing ESG requirements; establishing measurable and comparable key performance indicators; assessing maturity in ESG practices; and facilitating consistent, comparable, and reliable ESG reporting.

GRI 101: Biodiversity 2024

GRI’s revised biodiversity reporting standard can help you understand and disclose your most significant biodiversity impacts. It covers supply chain impacts, location-specific reporting, disclosures on direct drivers of biodiversity loss, as well as social impacts related to biodiversity loss. This resource will be most useful to sustainability professionals.

GRI 306: Waste

The GRI Standards enable organisations of all sizes to better understand and report on their impacts on the economy, the environment, and peoples, and in comparable and credible ways. GRI 306 can help you to disclose information on how your organisation prevents waste generation and how it manages waste that cannot be prevented, both within your operations and across your value chain.

ESG Disclosure Handbook

As ESG reporting requirements evolve, many companies find themselves struggling to provide forward-looking, investor-grade information. This guide from WBCSD provides a 3-part structured process for selecting and structuring inputs during the ESG reporting decision-making process. For practitioners involved in corporate disclosure activities, this handbook directly addresses many of the most common questions that Boards of Directors and other executives have about ESG disclosure.

The TPT Disclosure Framework

This disclosure framework from the Transition Plan Taskforce (TPT), a UK government initiative, can help you understand how to prepare a robust climate transition plan as part of your annual reporting. It outlines what a good practice transition plan is, based on the International Sustainability Standards Board’s (ISSB) definition and how the framework aligns with the ISSB’s climate-related disclosure Standard, and provides recommendations for effective reporting.

Accountability for Nature: Comparison of Nature-Related Assessment and Disclosure Frameworks and Standards

This report from UNEP can help you understand the evolving landscape of nature-related disclosure frameworks and assessments. It compares the approaches of major frameworks, such as CDP, ESRS, GRI, ISSB, SBTN, and the TNFD, highlighting common trends and identifying the ways in which they differ. The authors plan future research as continued changes are expected, such as the transition from voluntary to mandatory disclosure requirements. This resource will be especially useful to sustainability practitioners and legal teams.

Comparing sustainability standards and regulations: ESRS, IFRS S1/S2, SEC Climate Rule, and CA SB 253/261

This report from the ERM Institute provides a comprehensive assessment of four key sustainability standards and regulations. It provides a brief overview of the regulations and standards; compares key elements, such as jurisdiction, time to implementation, non-compliance penalties, and reporting requirements; and provides an overview of climate-specific disclosure requirements. This resource will be especially beneficial to sustainability and compliance professionals, and is a good primer for senior leaders.

Disclosing With Purpose: Guidance for Preparers and Users of Purpose Disclosures

This guide was created to help organisations that have embraced their social purpose and want support with disclosing their progress to advancing and achieving it. The guide proposes a voluntary, four-part framework consisting of purpose disclosure objectives with examples of how to fulfill them. Part 1 includes an introduction and summary of the purpose disclosure guidance; part 2 explains the framework elements, highlights examples of current practice, and discusses conceptual and practical issues; part 3 unpacks the framework in detail; and part 4 features frequently asked questions and sources.

Although the primary audience for this guidance will be the preparers and users of social purpose disclosures, the framework will benefit any organisation that wants a structured and credible way to report on its purpose, whether or not it’s a social purpose.

Assessing the credibility of a company’s transition plan: framework and guidance

This comprehensive guide from the World Benchmarking Alliance can help you to assess the credibility of companies' transition plans, including your own. The guide defines a credible transition plan, outlines key principles for assessment, presents a credibility assessment framework, and outlines crucial steps for holistically assessing a company's transition plan.

Although this resource was created for assessors, the framework provides harmonised guidance that can help you to better understand the kinds of information (and framing) to include in disclosure documents.

Basic Sustainability Assessment Tool (BSAT)

Pressure is growing on organisations to provide investors, lenders, and other stakeholders with baseline information on the sustainability of direct and indirect operations. To support change agents with preliminary assessments, Sustainability Advantage has created this free, open-source tool to help companies track their impacts. This comprehensive, generic tool is designed for use by organisations of all sizes, and in any sector and country. It assesses performance on 18 core sustainability issues, relative to science-based goals, as well as progress on reducing and/or eliminating harmful impacts on the environment, employees, and society. It also factors favourably for organisations that are supporting regenerative efforts - either directly or indirectly - through their products, services, and philanthropy, as well as other functions or activities may amplify the positive impacts of others. These scores are then automatically mapped to related, primary SDGs and the three extra-financial capitals (natural, human, and social).

This resource will be especially helpful for small- and medium-sized enterprises (SMEs), as well as large organisations with minimal or no sustainability staff.

Advanced Sustainability Assessment Tool (ASAT)

The free, open-source tool from Sustainability Advantage can help you to assess your company's sustainability performance. Whereas the Basic Sustainability Assessment Tool (BSAT) is intended for use by SMEs and large companies with minimal or no sustainability staff, this tool was created to help large, multi-location, multinational corporations with sustainability professionals on staff. The ASAT assesses company sustainability performance using the Future-Fit Business Benchmark Break-Even Goals and Positive Pursuits, and is based on the Future-Fit Progress Calculators worksheets created by the Future-Fit Foundation. It then maps those scores to related, primary SDGs and the three extra-financial capitals (natural, human and social).

Net-Zero Ambition Assessment Tool (NZAAT)

There are free and effective questionnaires that can be used to score suppliers’ commitment to, and progress toward, science-based net-zero targets and to circularity (e.g., CDP, UN’s Race to Zero, SBTi, Canada’s Net-Zero Challenge), as well as for-fee questionnaires (e.g. from EcoVadis, Cority, Sphera). However, these frameworks are largely designed for use by large suppliers, rather than for small- and medium-sized enterprises (SMEs). This free, open-source tool from Sustainability Advantage was created to provide a comprehensive, SME-friendly assessment tool. This generic tool enables a supplier to self-assess its commitment to science-based net-zero greenhouse gas (GHG) targets and to circularity.

Guidance on Assuring GHG Emissions with AA1000AS v3

Many organisations are expected - or required - to independently verify their GHG data through third parties. This extra level of assurance builds confidence in the methods used by the organisation to calculate GHG emissions, while also standardising the data in a way that fosters comparability and transparency for carbon accounting and reporting. This new guide from AccountAbility can help you to review and verify your greenhouse gas (GHG) emissions. Designed to complement the AA1000 Assurance Standard v3, the guide focuses on the processes required for responsible and complete assurance engagements based on the AccountAbility Principles of Inclusivity, Materiality, Responsiveness, and Impact. It explains preconditions for an AA1000AS v3 engagement; the approach for conducting such an engagement; and how to issue an AA1000AS v3 assurance statement and optional report to management. This resource will be of particular benefit to any professionals involved in collecting, managing, and reporting climate-related information.

The Task Force for Corporate Action Transparency (TCAT)

The Task Force for Corporate Action Transparency (TCAT) is a new initiative dedicated to strengthening the credibility of corporate climate action through transparent, verified, and third-party assurable accounting and reporting guidance. Until now, companies have been able to report numerical emissions data through frameworks like the Greenhouse Gas (GHG) Protocol or set reduction targets through initiatives like the Science Based Targets initiative. However, these frameworks lack standardised methods for companies to report the specific actions behind those reductions (e.g. transport companies replacing diesel trucks with electric vehicles, manufacturers capturing and storing carbon dioxide in underground reservoirs, etc). TCAT intends to develop, publish, and promote technical guidance and methodologies that help companies report emissions reduction and removal efforts transparently and clearly, and address gaps in financial and GHG accounting, reporting, and assurance by developing and aligning with best-in-class standards and practices

TCAT has launched two comprehensive GHG reporting frameworks. Developed through a collaboration among environmental groups, accounting experts, NGOs, business practitioners, and civil society members, the guides are designed to help companies explain exactly how they are lowering their emissions in real time, and in a way that is comparable across industries and verifiable by third parties. These guides are designed to fill an important gap in how companies measure, report on, and verify their corporate climate actions.

The first framework is Mitigation Action Accounting and Reporting Guidance (MAARG), which equips companies with tools to account transparently for the full spectrum of ton-denominated climate actions. Its multi-statement approach enables companies to report on climate actions without conflating different types of activities; MAARG’s framework allows each action to be clearly categorised and measured. Rather than consolidating all GHG-related activities into a single statement, which can obscure the distinction between actual emission reductions and accounting-only or business changes, MAARG introduces a five-statement reporting framework which supports both inventory and impact accounting: physical inventory statement, contractual inventory statement, inventory impact mitigation statement, sector impact mitigation statement, and global impact mitigation statement.

TCAT’s second new framework is the Target Accounting and Reporting Guidance (TARG), which provides structured guidance for setting voluntary climate targets, tracking progress, and communicating results. This standardised approach enables stakeholders to assess the credibility and ambition of corporate climate targets and evaluate actual performance against commitments. In the absence of a unified framework in the voluntary reporting space, TARG fills a critical gap by offering clear and consistent methods for companies to disclose climate targets and report progress in a transparent and assurable manner. The framework is built around five core reporting elements: a target commitment report, base year emissions report, mitigation action report, target accounting report, and target attainment report.

Other Resources

The Reporting Exchange

Developed by WBCSD and now a part of ESG Book, the Reporting Exchange is a free online platform that connects you to reliable, comparable information on sustainability reporting requirements and resources. The platform provides detailed, up-to-date coverage from 60 countries and across dozens of sectors, and will help change agents, investors, and leaders within your company who want relevant resources for comparing, preparing, and delivering corporate sustainability reports. The platform's global database contains mandatory and voluntary disclosure requirements, sustainability ratings, rankings, and indexes, and allows you to connect, share, and track relevant updates.

Valuing Nature: The case for nature-related assessment and disclosure

This report by the SustainAbility Institute and the Capitals Coalition builds a case for nature-related disclosure and provides a roadmap for how businesses can approach it. The report unpacks new nature frameworks; connects the Capitals Coalition’s Natural Capital Protocol with the Taskforce for Nature-related Financial Disclosure's (TNFD) beta framework; and outlines a set of nature-related actions that your company can and should take today. This is a good resource for preparing leaders and boards to make clear, consistent, and timely nature-related disclosures upon the TNFD's launch.

Business reporting on the SDGs: An analysis of the Goals and Targets online database

This comprehensive database from the Global Reporting Initiative (GRI) can help you to effectively integrate the Sustainable Development Goals (SDGs) into your reporting processes. It features a comprehensive inventory of potential disclosures at the targets level for each of the SDGs, and allows you to search by SDG and SDG target, sector, and source. This resource will be most useful to sustainability teams seeking to align their reporting with global goals.

Business Reporting on the SDGs - An Action Platform

The Global Reporting Initiative (GRI) and the United Nations Global Compact (UNGC) have released a comprehensive action platform with three primary deliverables to accelerate corporate reporting on the Global Goals.

The first publication is the report An Analysis of the Goals and Targets, which aims to help companies understand how they are impacting the SDGs and their targets, and provides a list of indicators to make reporting on the SDGs simple and straightforward.

The second publication, Integrating the SDGs into Corporate Reporting: A Practical Guide, aims to support companies in prioritising, measuring, and reporting on their impact on the SDGs, as well as setting related business objectives. This guide outlines a three-step process to embed the SDGs in existing business and reporting processes and builds upon a suite of existing and established resources, including the UNGC’s Ten Principles, the UN Guiding Principles on Business and Human Rights, and the GRI Sustainability Reporting Standards.

Finally, the third publication, In Focus: Addressing Investor Needs in Business Reporting on the SDGs, informs investor-relevant aspects of corporate SDG reporting.

Advancing modern slavery reporting to meet stakeholder expectations

This toolkit was created by GRI and the Responsible Labor Initiative (RLI) to encourage and improve reporting on modern slavery and to support action across the value chain. This toolkit will help change agents to understand why modern slavery has become increasingly important to corporate sustainability reporting, and includes a practical approach for them to report on the issue in alignment with stakeholder expectations. Included are summaries of key slavery-related topics, questions, and concerns; reporting examples; testimonials from reporters and stakeholders; relevant GRI standards guidance; and examples of tools that will facilitate your reporting.

Corporate Climate Responsibility Monitor 2025

This report from the NewClimate Institute and Carbon Market Watch can help you to understand the key elements of corporate climate responsibility and to see how other leading companies are progressing against their targets (if at all). It includes good practice principles for tracking and disclosing emissions, setting targets, reducing emissions, and for climate contributions and offsetting. It includes trends, examples of good role models, and examples of insufficient practices, as well as assessments of the integrity of climate pledges from dozens of the world's largest companies.

Art of Alignment

This research report from SustainAbility offers guidance on best practices to help practitioners better align their company's sustainability and financial transparency. The document helps to explain the evolution and current trend of sustainability transparency and its relationship with financial disclosure, and provides a helpful roadmap that explores four core elements of alignment: audience, materiality, curation, and delivery. The report also provides brief case studies which highlight best practices in relation to these core elements.

r3.0

Towards achieving a regenerative and inclusive global economy, r3.0 crowd-sources expert input into their 'blueprint' reports, which include examples and recommendations for redesign in the fields of reporting, accounting, data, and new business models. For practitioners seeking a new 'common ground,' these blueprints may help you to identify and fill gaps between current practices and necessary progress.

ESG Reporting Guide 2.0: A Support Resource for Companies

This informal reference guide from the Nasdaq Stock Exchange will help you to better understand and identify the latest environmental, social, and governance (ESG) reporting standards and methodologies and to navigate the evolving standards on ESG data disclosure.

Five Steps to Good Sustainability Reporting

This report from BSR draws on features from notable reporting standards and frameworks - including GRI, SASB, and the TCFD - and presents a five-step process for effective disclosure. While the first step in couched in materiality, from which leading companies are moving beyond, steps 2-5 will be particularly helpful for first-time reporters to better evaluate and understand their audience and the presentation and formatting of their report.

The double-materiality concept: Application and issues

If you are looking for a more comprehensive explanation of the concept and applicability of double materiality, this white paper from GRI may be of help. It draws on academic research to investigate how double-materiality is implemented in sustainability reporting and identifies some of the benefits and challenges when applying double-materiality in practice.

Double and Dynamic: How to Enhance the Value of Your Materiality Assessment

BSR has created a blog series focused on expanding the scope and value of materiality assessments. The first can help you to understand the value of taking a scenario-driven approach to double materiality, where stress-testing and scenario analysis are used to determine which sustainability issues are most likely to challenge and undermine the resilience of your organisation. The second can help you to understand the value of taking a scenario-driven approach to double materiality, where stress-testing and scenario analysis are used to determine which sustainability issues are most likely to challenge and undermine the resilience of your organisation. The third can help you to understand the benefits of focusing your materiality assessment on your company's impacts on communities, the environment, and other affected stakeholders rather than on decision-useful disclosures for investors and other report readers.

Transition Plan Content Index

Net-zero transition plans are an essential part of net-zero goals, and yet transition plan disclosures are fragmented and non-standardised. This tool - developed by a coalition of NGOs, including C2ES, BSR, Ceres, the Environmental Defense Fund (EDF), and We Mean Business Coalition (WMBC) - was designed to help you increase the transparency and comparability of your net-zero transition plan by creating a reference document called a Transition Plan Index. The tool is based on a Microsoft Excel workbook that lays out key transition plan elements taken from a number of leading transition frameworks. The workbook acts as an index template featuring all the required transition plan elements. This allows you to reference a source for each element that you already have documented as well as check for elements that are missing. By publishing a transition plan index annually, you will help stakeholders and investors quickly find and review elements and track your transition plan completeness. This tool will be most useful to sustainability practitioners.

Natural Capital: The Next Evolution of Environmental Reporting

This paper from ISS Governance can help you to better understand the state of play regarding natural capital reporting and developments in the proxy voting space. It highlights the evolution of reporting frameworks and their common themes; provides stakeholder groups mapping; and features analyses of natural capital-related shareholder proposals, including those related to agricultural impacts, chemical pollution, deforestation, extractive impacts, lobbying, plastic pollution, and water-related risks. This resource will be especially helpful for change agents supporting sustainability-related disclosures, senior leaders, and investor engagement professionals.

The Project Sustainability Reporting Guide

This comprehensive guide from the PMI GPM Sustainability Joint Venture can help you to better understand and report on sustainability outcomes related to projects. Aligned with global and regional frameworks, including IFRS S1 & S2, CSRD, CSDDD, GRI Standards, and the Kunming-Montreal Global Biodiversity Framework, and integrating the concept of context-based sustainability, the guide provides a practical, step-by-step roadmap for integrating sustainability directly into project management and linking project data to global reporting frameworks. It explains why projects matter for sustainability reporting; explains essential principles and core concepts that underpin project-level sustainability and materiality management; unpacks GPM's P5 Standard for Sustainability in Project Management; and explains how to bridge P5 to materiality. The guide also provides sector-specific guidance, explores crosscutting topics (such as climate & energy, water & waste, biodiversity & ecosystems, digital responsibility, governance & advocacy, and more), and features a range of ready-to-use tools and templates. This guide will be beneficial for both project managers and sustainability professionals.

Share this Practice on:LinkedIn